The First of Its Kind: How Finance Lobby Improved Commercial Real Estate Financing in 2021

Press Release

Published: Jan. 23, 2022 at 8:17 p.m. ET

Jan 23, 2022 – The commercial real estate (CRE) investment landscape is evolving in significant and exciting ways, as attested to by crowdfunding and other trends.

But even with this sizable increase in investment opportunities, many brokers and lenders still face some recurring problems: spending valuable time on deals that go nowhere, wading through numerous unattractive options to find one that fits their criteria, and many others.

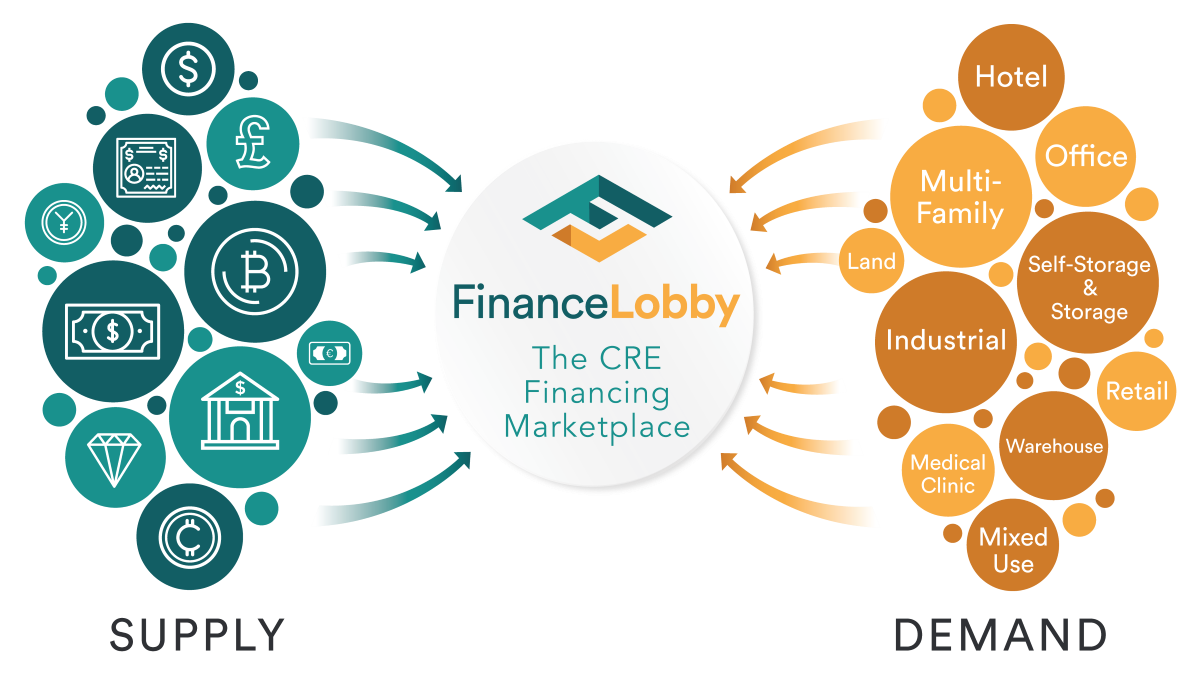

At Finance Lobby, they’re modernizing CRE investing. The process of finding a loan that will meet specific needs has always been time-consuming and frustrating until now. Their CRE financing marketplace changes the game by connecting brokers and lenders faster and more efficiently than ever before.

By posting requirements on a robust and well-populated commercial real estate financing marketplace, brokers quickly receive proposals from commercial lenders all over the country. This saves time and provides access to a wider variety of options that wouldn’t have been available otherwise. Think of it as an Uber or Lyft for finding CRE deals instead of rides.

How Does Finance Lobby Make Lives Easier?

Whether you’re a CRE lender or broker, they eliminate many roadblocks to successful deals. Lenders receive:

- Notified whenever there is a deal in their defined market with their desired criteria, so they never miss out on a potential deal.

- All the information that makes or breaks deals, like the considered nuances the borrower wants, so lenders can provide tailored, competitive quotes.

With Finance Lobby, brokers:

- Get 1,000’s of eyes on every loan request to land the terms that matter most to their clients.

“Digitizing CRE financing makes the entire process more efficient and simpler for lenders, brokers, and borrowers alike,” says Kelly Wagman, Chief Marketing Officer of Finance Lobby. “Simply put, we know how valuable your time is, so we’d love to give more of it back to you.”

Finance Lobby added 2,000 lenders of all types; community banks, credit unions, and large national banks to provide coverage in all 50 states and every county. Embrace the future of CRE investing today.

Contact: