Finance Lobby Disrupts the Commercial Real Estate Financing Marketplace

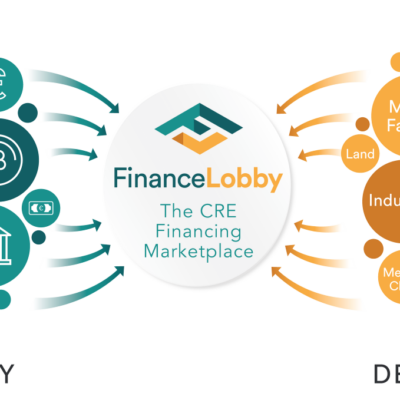

Professionals in commercial real estate financing have long said that the industry is ripe for change due to its systemic inefficiency. In searching for solutions, they have run up against the reality that when there is one property that three sides have a potential stake in – the commercial borrower, broker, and lender, all with their own needs – it is not always so easy to find a solution. There are, after all, many moving parts for each one, and finding the fix, so to speak, can be difficult to accomplish. This is why the announcement of the software designed by Finance Lobby LLC is generating such buzz. With one platform, the company is streamlining how commercial real estate is financed, and it has the potential to overhaul an entire industry.

The Problem of Inefficiency in the CRE Financing Marketplace

To understand the excitement, it can help to first visualize the state of commercial real estate financing before Finance Lobby unveiled its software. At the center of any transaction, of course, was a commercial property, perhaps a mall or a vacant store. A company or individual that was interested in acquiring it and needed financing for it usually sought out the help of a commercial broker, who got busy contacting CRE lenders for soft quotes. Anyone who has ever sought out quotes for the costs of insurance policies or cars can foresee what happened next: the endless back and forth of phone calls between the broker and lender as each tried to establish terms that were mutually profitable.

“Also at question was whether all sides were seeing all of the deals that were actually available in real time,” says Finance Lobby. “When we analyzed the commercial real estate financing marketplace, we saw a lot of dedicated professionals who had the talent and skills to do their jobs well and who cared about serving their clients. However, they were hampered by an old-school way of conducting their business, so we decided to step in with our software and provide the answers so many people were searching for.”

The Solution that Finance Lobby Designed for Commercial Real Estate Lenders

“Through our platform, we are accomplishing one of our biggest goals: to introduce more precision into the lives of CRE lenders,” says Finance Lobby. “They are incredibly busy people, and what we heard time and again was that they spent too much time on the phone, trying to nail down terms that worked and create soft quotes that met the borrower’s needs. It was an inevitable part of the CRE financing process, but we believed we could make it a lot easier.”

Finance Lobby reveals that it has designed its software to include the ability for CRE lenders to set their preferences for terms before they even look for deals. “What this does is give them access to deals they want instead of them having to look at deals that are irrelevant,” the company says. “It also brings up every deal in the market, so the CRE lender does not have to worry that they are overlooking something important.”

It adds that the CRE lender can more easily make soft quotes that are accurate and fast. “We also help them to communicate directly with the broker. It truly is a more efficient way for the CRE lender to conduct business,” Finance Lobby states.

The Solution That Finance Lobby’s Software Provides for CRE Brokers

The situation faced by commercial real estate brokers was just as challenging. Even the most experienced faced multiple phone calls as they searched for loan terms that satisfied their clients. “Many CRE brokers have told us that even when they did get the terms, they weren’t really satisfactory for their clients, so it wasn’t the outcome that they were seeking,” Finance Lobby says.

For CRE brokers, the company built into its software key capabilities, including the ability to get thousands of eyes on every loan request, preferred access to the broker’s favorite lenders, and comparisons of multiple offers before selecting the one that is right for the broker’s client.

“Our software removes so many of the hurdles that have frustrated CRE brokers for years,” states Finance Lobby. “It is designed to simply make their workdays much easier for them and their clients.”

The Takeaway for Professionals in the Commercial Real Estate Lending Marketplace

With algorithms that match brokers and lenders, alerts when there are perfect deals, and access to deals like assets and sponsors, Finance Lobby’s CRE software is changing the commercial real estate industry. Over 4,000 lenders are already on the platform,

“This is an amazing number,” Finance Lobby believes. “This is the value of a marketplace. Our CRE platform has a huge value and a vast number of options for any CRE broker or lender who is tired of doing business as usual and is ready to see what it is like to shift their business into the next gear.”

For more information about Finance Lobby, please see the company’s website at financelobby.com or contact it at hello@financelobby.com.