Finance Lobby and Its Benefits for Commercial Real Estate Brokers and Lenders

Press Release

Published: March 7, 2022

As the CRE (Commercial Real Estate) landscape continues to evolve, especially as its demands significantly increase in 2022, various ways of meeting its needs have swept across the industry. McKinsey & Company, a management consulting company, shares their insights on the current trends in commercial real estate. “Given the potential for transformative changes [in a post-coronavirus environment], real estate players will be well-served to take immediate action to improve their businesses but also keep one eye on a future that could be meaningfully different.“

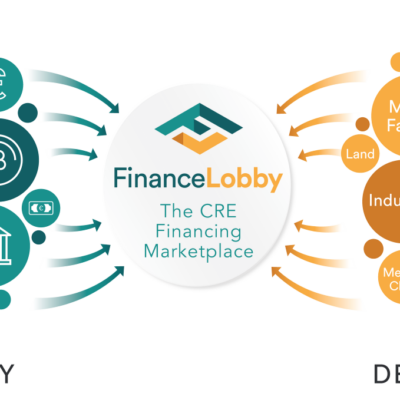

Finance Lobby has developed the leading marketplace model for the commercial real estate industry. Conceived, designed, built, and brought to market by a passionate group of high-performing mortgage professionals, Finance Lobby is driving a dynamic and more efficient process between commercial real estate brokers and lenders to keep up with the fast-paced demands of the CRE landscape.

3,500 lenders and brokers across the US benefit from Finance Lobby’s revolutionary commercial real estate financing marketplace, the CRE financing marketplace has already facilitated over $600M in CRE deals within the first few months of 2022.

Benefits for commercial real estate brokers

Brokers will no longer be overwhelmed by a vast array of loan programs offered by thousands of lenders. They can efficiently “comparison shop” across multiple offers and compare them side by side to conveniently assess which offer has the best suitability for their clients or requirements. The highly intuitive feature allows clients to receive only the best deals to get their loans approved.

Once brokers find their preferred lenders, they can opt to give them early access to their deals. Finance Lobby also provides exclusive access to their preferred lender, so that no other lender from the same company can quote on the deal. This ensures a smooth and healthy relationship between both parties unless other factors are involved, like a lender passing on the deal or not responding within a set time frame.

Finance Lobby‘s built-in chat feature allows brokers to contact lenders directly once a deal has been accepted, guaranteeing that all personal information and transactions are kept confidential until the best lender is selected, while allowing for direct communication to facilitate the deal. This prevents brokers from receiving unsolicited messages or irrelevant loan offers, making the whole process hugely time efficient.

Benefits for commercial real estate lenders

Lenders will no longer need to waste so much time reviewing countless deals for various properties. Lenders who sign up on the platform are guaranteed to receive new deal requests that best fit their preferences, so that they won’t need to waste time sorting through any irrelevant offers on the platform. All the crucial details that usually make or break deals are presented upfront – this includes assets, sponsors, experience, and preferences that often make or break contracts. Lenders can also create up to four variations of their soft quotes directly on the site so that brokers can have more variations to choose from and compare it with the other similar loan packages quoted.

Created specifically for the digital age, Finance Lobby’s online platform makes it more convenient for lenders to update their profiles (much like any social media profile) whenever their business preferences change. This feature ensures that the kinds of deals visible to the lenders are always relevant to their requirements.

Catering to the increase in demands through digital relevance

Creating a more seamless process for brokers and lenders to close the best deals for their clients is just the first step. With more and more borrowers experiencing the best kind of client services satisfaction through efficiency and higher closed deal rates, Finance Lobby continues to gain loyal clients. Using Finance Lobby as an online commercial real estate marketplace is effortless for all parties involved by simply using one platform to achieve many necessary tasks. Deals are being closed faster, clients are happier, and the gap between potential clients and empty spaces gets closer with every successful transaction.