Lenders

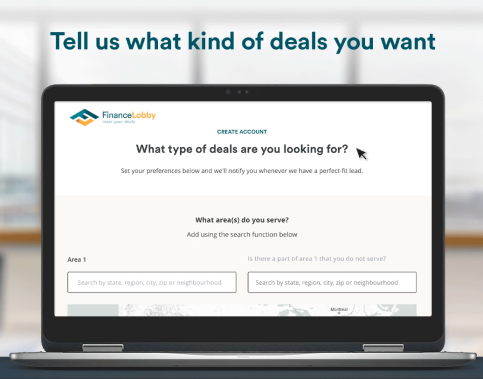

Set your preferences and work only on commercial

real estate deals that meet them

Why field calls and meetings on deals you can’t even do? Why constantly be troubled with deals you don’t want or have to bend your lending criteria just to meet? CRE financing has long had these mismatches built into the process, with wasted time considered par for the course and a sunk cost.

Finance Lobby is modernizing the financing industry with a commercial real estate financing marketplace that fixes the inefficiencies to deliver only what you and your institution are looking for. A one-stop solution that automatically finds every deal in your market that matches your criteria, and lets you close on them faster than ever before.

Eliminate Waste, Close Deals Faster

Know you’ll close before you start

Finance Lobby alerts you to every deal in your market that matches your precise lending criteria, so you’ll spend less time hunting and more time focused on revenue-generating and customer-facing activities. Spend time on the things that matter most.

Get DealsHere’s how:

Go beyond the basics and work with the subtleties that guarantee the deal on a platform that easily integrates into your current workflow.

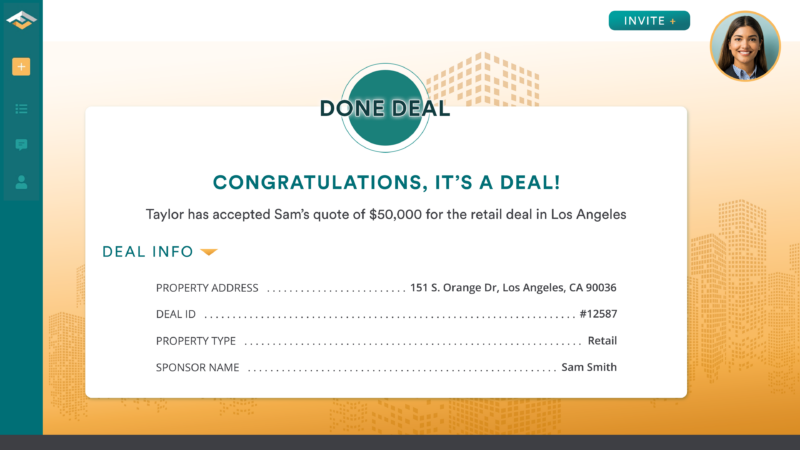

More deals aren’t necessarily better, only better deals are better. With Finance Lobby that’s exactly what you’ll get. It takes less than 60 seconds to sign up for a free, no obligation Finance Lobby account, and you won’t pay anything until after you’ve made your first deal. Give it a try today and find out why thousands of commercial estate lenders are already using Finance Lobby to save time and boost their close rate.

Get in touch with our Lender’s Customer Support team

Lender Inquiries

For general inquiries, please email:

Know you’ll close before you start

Finance Lobby is modernizing the financing industry with a commercial real estate financing marketplace that fixes the inefficiencies to deliver only what you and your institution are looking for.

A one-stop solution that automatically finds every deal in your market that matches your criteria, and lets you close on them faster than ever before.

Unlock Perfect-Fit Deals NowFAQ

Does Finance Lobby accept co-brokerage?

Co-brokerage is not accepted at Finance Lobby. To avoid co-brokerage, every broker and lender is carefully vetted before being permitted to use the platform.

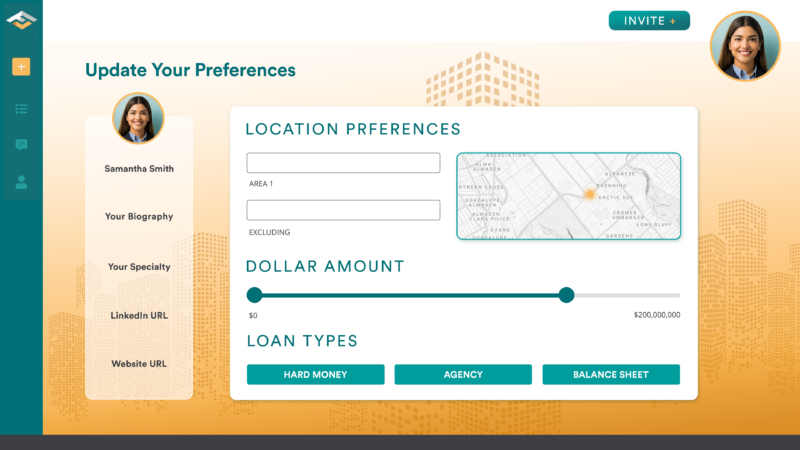

How do I change my lending criteria?

To change your lending criteria, simply log in to your account and adjust your criteria in your profile settings.

How often can I change my lending criteria?

As often as you like. Finance Lobby makes it easy to adjust your lending criteria on the fly, allowing you to adapt to new market and lending conditions.

What if I want to send a referral to someone else in my company?

Once you create your own account, you will be able to send invitations to others.

What if we are not a transactional bank? Can Finance Lobby still work for us?

Yes. When you submit a quote, Finance Lobby gives you the ability to require that the borrower bring with them a deposit relationship.

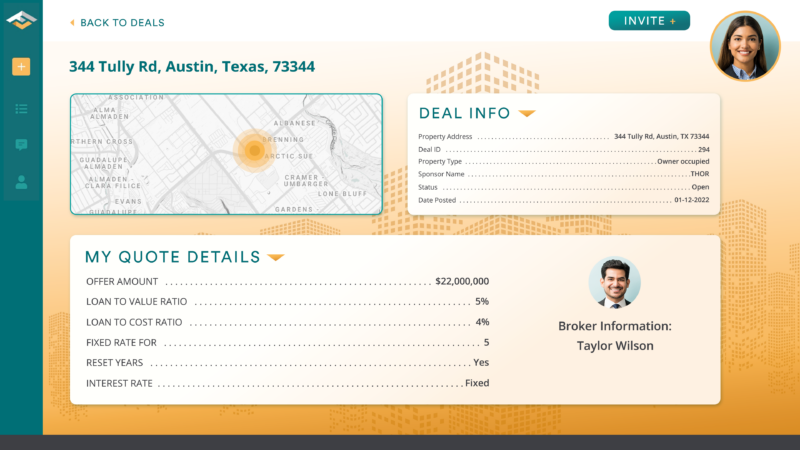

What happens after I submit a quote? Do I close through Finance Lobby?

Closing will happen outside of Finance Lobby and will follow the same steps you traditionally use. Finance Lobby simply serves as a marketplace to facilitate the interaction between brokers and lenders. Think of Finance Lobby like a home buying website – you search for homes online, then close offline.

Will my co-worker also be able to quote on my existing customer deals?

No. Once you’ve established a relationship with a customer on a specific deal, you will be in charge of that deal and all future deals for that customer that involve your company.

I changed employers, how do I update my profile?

If you change employers, simply create a new profile with your new email address. It takes less than 90 seconds!

When I submit a quote, does it go to Finance Lobby or to the broker?

Soft quotes go to the broker. Finance Lobby simply acts as a marketplace to facilitate the interaction between you and the broker.

If I submit a quote through Finance Lobby, will the quote be binding?

No, quotes through Finance Lobby are not binding and are for discussion purposes only. They are not intended to be, nor should they be construed as, a commitment to lend, but serve merely as a preliminary description of possible terms of the proposed financial request. These terms and the financial request are subject to further review, analysis, consideration and final approval. The terms outlined may be modified in whole or in part during this review. However, we do ask that you make your quotes in good faith and refrain from dramatically changing your quote after the fact. All parties, including brokers, will be made aware of the soft nature of the quote as described above.

What information will I be provided with in order to give a soft quote?

You will be provided with all the information on the property (Rent roll, income, and expenses), the sponsor’s financial information (net worth, experience, etc) and any relevant details about the deal. In the event of an owner-occupied property, you will also be given all the information on the business’s financials.

Where does Finance Lobby source its deals?

From brokers and borrowers searching for a lender. Finance Lobby is a marketplace that allows brokers and borrowers to create and post their own deals. This gives brokers and borrowers the ability to get their deals in front of every potential lender, and lenders an opportunity to see every active deal in the market.

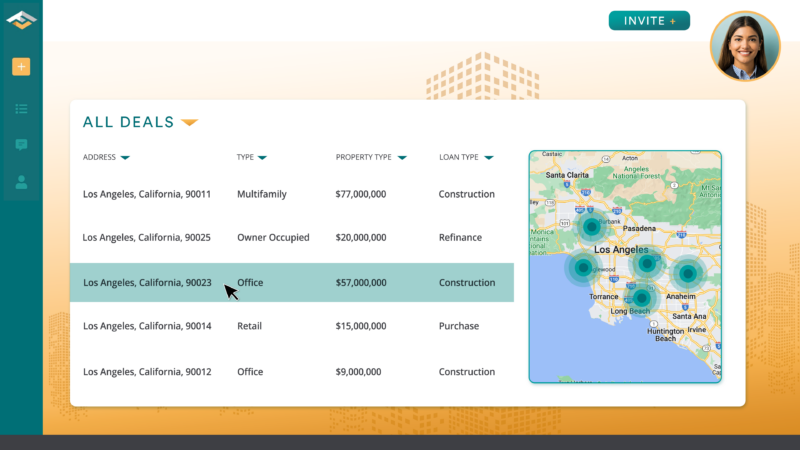

See all the deals you want and none of those you don’t

- See strictly the deals that meet your lending terms – nothing else

- Your CRE loan is in the running for every deal in your market

- Our algorithm automatically adjusts when you change your criteria

- Receive detailed borrower preferences that ensure the most competitive soft quotes