Finance Lobby Streamlines the CRE Financing Marketplace

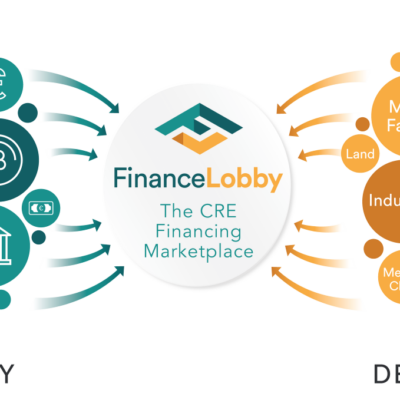

You may not realize it, but that vacant storefront that you pass on your way home from work is the focus of multiple phone calls each day. It is at the center of a triangle that includes the CRE lender, broker, and borrower, all of whom negotiate with each other for the best lending terms for the property. Until recently, CRE professionals largely conducted their work via their phones even though most industries have transitioned to online technology. Now, however, with the launch of the cutting-edge platform created by Finance Lobby, commercial real estate brokers and lenders are making fewer phone calls and securing better terms for the deals they want.

How Inefficiency in the CRE Financing Marketplace Led to Finance Lobby’s Innovation

The advancement, Finance Lobby believes, is long overdue. “Tech is developing rapidly each day and bringing many benefits to society, so it was surprising to us that the CRE lending marketplace had not yet benefited from it. We asked ourselves one question: did CRE brokers and lenders really have to spend so much time contacting each other in the pursuit of soft quotes and deal terms? The answer had to be no.”

Finance Lobby adds that it also wanted to give lenders the ability to see relevant deals that were actually available in real time. “When we analyzed the commercial real estate financing marketplace, we saw a lot of dedicated professionals who had the talent and skills to do their jobs well and who cared about serving their clients. However, they were hampered by an old-school way of conducting their business, so we decided to step in with our software and provide the answers so many people were searching for.”

How Commercial Real Estate Lenders Will Benefit From Finance Lobby’s Solution

“Through our platform, we are accomplishing one of our biggest goals: to introduce more efficiency into the lives of CRE lenders,” says Finance Lobby. “They are incredibly busy people, and what we heard time and again was that they spent too much time on the phone, trying to nail down terms that worked and create soft quotes that met the borrower’s needs. It was an inevitable part of the CRE financing process, but we believed we could make it a lot faster and easier.”

Finance Lobby reveals that it has designed its software to include the ability for CRE lenders to set their preferences for terms before they even look for deals. “What this does is give them access to deals they want instead of them having to look at deals that are irrelevant,” the company says. “It also brings up every deal in the market that meets their criteria, so the CRE lender does not have to worry that they are overlooking an important opportunity.”

It adds that the CRE lender can more easily make soft quotes that are accurate and fast. “We also help them to communicate securely and privately directly with the broker after the deal has been accepted. It truly is a more efficient way for the CRE lender to conduct business,” Finance Lobby states.

The Solution That Finance Lobby’s Software Provides for CRE Brokers

The situation faced by commercial real estate brokers was just as challenging. Even the most experienced faced multiple phone calls as they searched for loan terms that satisfied their clients. “Many CRE brokers have told us that even when they did get the terms, they weren’t really satisfactory for their clients, so it wasn’t the outcome that they were seeking,” Finance Lobby says.

For CRE brokers, the company built into its software key capabilities, including the ability to get thousands of eyes on every loan request, preferred access to the broker’s favorite lenders, and comparisons of multiple offers before selecting the one that is right for the broker’s client.

“Our software removes so many of the hurdles that have frustrated CRE brokers for years,” states Finance Lobby. “It is designed to simply make their workdays much easier for them and their clients.”

What Finance Lobby’s Platform May Mean for CRE Professionals and the Industry

With a system that uses algorithms to match brokers and lenders and that sends deal alerts straight to the user’s inbox, the CRE professional now has a powerful tool that is designed to optimize each work day. What will that mean for CRE brokers and lenders?

“We hope it brings the fun back into their jobs,” Finance Lobby says. “So much of the repetitiveness that hindered brokers and lenders is now gone from the lending process. We believe our innovation will re-energize CRE professionals and allow them to focus on what they do best: making the best deals. With over 4,000 lenders on our platform, we feel confident that we are changing the commercial real estate industry for the better.”

For more information about Finance Lobby, please see the company’s website or contact it at hello@financelobby.com.