Finance Lobby’s Online Marketplace Model for CRE Benefits the New Normal Real Estate Trends

Press Release

Published: March 9, 2022

According to Forbes, CRE transaction volumes in the first ten months of 2021 rose 64% from the comparable period in 2020, and the trend seems to be continuing to rise exponentially in 2022.

2022 is probably the best time to invest in commercial real estate as the demand for commercial properties is bouncing back after the setbacks of the past two years. As CRE continues to recover and experience an increase in demand, industry front liners like Finance Lobby are at the leading edge of these forecasted trends, starting with the company’s online marketplace model for CRE financing.

Work from anywhere is here to stay

As more individuals continue working from home or engaging in a hybrid work environment, digital real estate continues to rise. The work-from-anywhere phenomenon has also driven rental and ownership markets to an all-time high which instigated higher demands for data centres, infrastructure and cell towers, and industrial logistics facilities in areas away from central business districts.

As more people continue working from home and anywhere else, so is the demand for businesses catering to this market such as co-working spaces, tech hubs, lounges, or coffee shops.

Out of office

As companies all across the globe navigate through the post-pandemic working environment, new rental and leasing behaviours came about. For example, hybrid work arrangements paved the way for companies to lease or move into smaller office spaces. Some locations have also granted leasing flexibility, including flexible or short-term leasing terms, free parking, and subleasing.

The trend in remote-working allowed others to move back to their hometowns away from major cities, giving way to better real estate opportunities in suburban and rural areas. In fact, surveys show a 10% increase in rental rates in smaller cities with lower commercial vacancies, and demands for warehouses and distribution centres beyond metropolitan areas have also become rampant.

Untouched by e-commerce

While the e-commerce industry has experienced rising success in the past two years and aided in strengthening industrial leasing for warehouses, storage facilities, and distribution centres, some activities are still best enjoyed outside. Dine-in restaurants, hair and nail salons, cinemas, hotels, and vacation rentals are some of the few places that immediately recovered as health restrictions gradually eased up. More opportunities in these fields are set to continue in 2022.

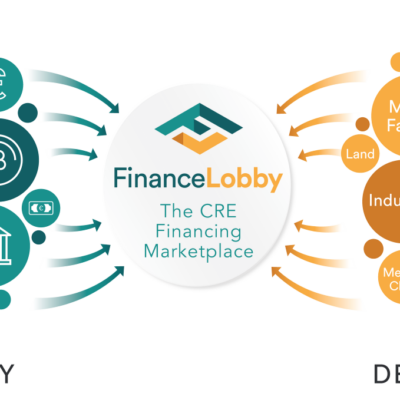

Finance Lobby and its online marketplace model

These forecasted 2022 trends were derived from industry shifts and consumer behaviour in 2021. As the real estate industry as a whole continues to “play it by ear” while catering to the demands of the new normal, Finance Lobby has already made its mark on the CRE sector with its revolutionary commercial real estate financing marketplace model. Brokers and lenders can collaborate much more effectively and efficiently through the online platform by eradicating the tedious procedure of back-and-forth communication just to close one deal.

Lenders can create up to four variations of their loan terms, and brokers can instantly compare offers to get the best deals for their clients, all operating under their specified preferences.

Finance Lobby has more than 3,500 lenders and borrowers using the platform already and has facilitated over $600M in CRE deals already in 2022. With the new economic trends and the rise in demand for commercial real estate in 2022, Finance Lobby continues to prove itself to be an influential market leader in the space and is guaranteed to have a successful year ahead.