Finance Lobby Offers Unprecedented Convenience for Commercial Real Estate Financing

Press Release

Published: February 11, 2022

The commercial real estate industry has generally not evolved for decades in terms of how securing financing and closing a deal works. Even as technology has moved at a breakneck pace, the CRE financing world has remained a few decades behind. Because of this, frustrated commercial mortgage lenders find themselves bending and stretching their criteria and wasting time on deals they can’t even do, while discouraged brokers spend months going back and forth trying to secure a loan that matches their clients’ criteria only to end up with a deal that doesn’t fully satisfy anyone.

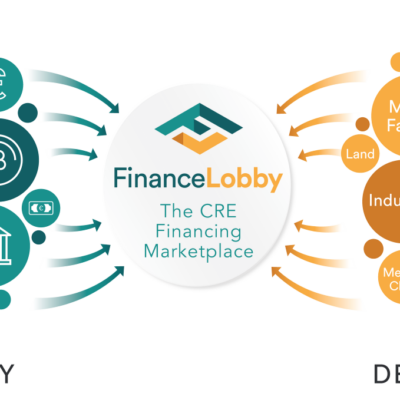

This is where Finance Lobby stands in the gap by offering a proprietary platform that connects sellers, buyers, and lenders, and allows users to drill down to the fine details of their commercial real estate projects without any extra effort. As the company explains, “with the help of Finance Lobby’s new Commercial Real Estate Financing Marketplace, lenders and brokers can now elate their respective clients with perfect-fit deals — and they can do so nearly effortlessly.”

The company has already engaged over 3,000 lenders on its platform and boasts an actively growing user base. Here’s how the platform works: lenders specify their criteria, so they only see deals that work for their organization. Brokers use a guided process to submit a single loan application to many lenders. This results in multiple competitive quotes so brokers can select the best one for their client. Lenders get notified whenever there is a deal in their defined market with their desired criteria, so they never miss out on a potential opportunity.

Finance Lobby CMO Kelly Wagman explains,

“Digital marketplaces are changing the way we purchase everything from cars to homes to vacations. And now, they’re shaking up the commercial real estate world, too.”

Wagman continues,

“We already have 3,000 lenders on the Finance Lobby marketplace, covering every state and county in the U.S. Now, brokers can find competitive quotes from numerous sources and lenders have access to a virtually unlimited number of prospects all in one place.”

With Finance Lobby, much of the typical guesswork involved in a commercial real estate deal is eliminated. Lenders get access to all the information from a broker that makes or breaks deals. If there are terms to be considered or nuances the borrower wants, lenders have the opportunity to provide tailored, competitive quotes. Brokers get to see every loan request to land the terms that matter most to their clients.

Learn more at financelobby.com