Defeasance: What Is It and How Does It Work in Commercial Real Estate?

There are multiple loan options when it comes to purchasing a commercial property, and in today’s changing world, traditional commercial mortgages aren’t the best fit for everyone’s goals and plans. Traditional loans might even prevent an individual or company from repaying their debt in a timely manner, which can prohibit long-term goals. These factors led to the creation of defeasance in the 1990s. While it’s always best to consider the advice of a professional consultant, more and more borrowers are turning to defeasance to reduce costs, offer a better time frame for repayment, and discover alternative payment strategies that offer the most benefits for the borrower.

What to Know When Considering Defeasance

The concept of defeasance was adapted to the commercial real estate market from the municipal bond market in response to the increasing securitization of fixed-rate loans. True prepayment of loans was restricted prior to 1998, and this made securitizations more attractive to investors as it enabled a predictable cash flow.

However, borrowers were looking for ways to exit securitized loans when selling or refinancing properties. Thus a strategy was created to allow borrowers to reduce or avoid particular fees on commercial mortgages. Now a borrower can choose defeasance to prevent fees associated with prepayment, and this benefits the lender by ensuring that both the interest and the principle are still being paid on the loan.

A defeasance in commercial real estate is basically an adjustment to a traditional contract. A traditional commercial mortgage lets the lender get a commercial mortgage-backed security, or CMBS. This guarantees a return on their investment and provides security for the lender and can mean the difference between whether or not to offer a mortgage for a commercial property.

But traditional commercial mortgages which utilize CMBS for security do limit prepayments, meaning that a borrower isn’t allowed to prepay on their loan unless they’re willing to pay large fees and other extra costs. This can mean significant problems for the borrower when they want to sell or refinance their property.

Commercial loan defeasance lets the borrower prepay on their loan and repay the entire amount to the lender through alternative securities. The borrower provides collateral in the form of government-backed security, like treasury bonds; which security would depend upon the mortgage’s interest rate. The ideal defeasance contract provides collateral that will offer the same rate of return as the original loan agreement.

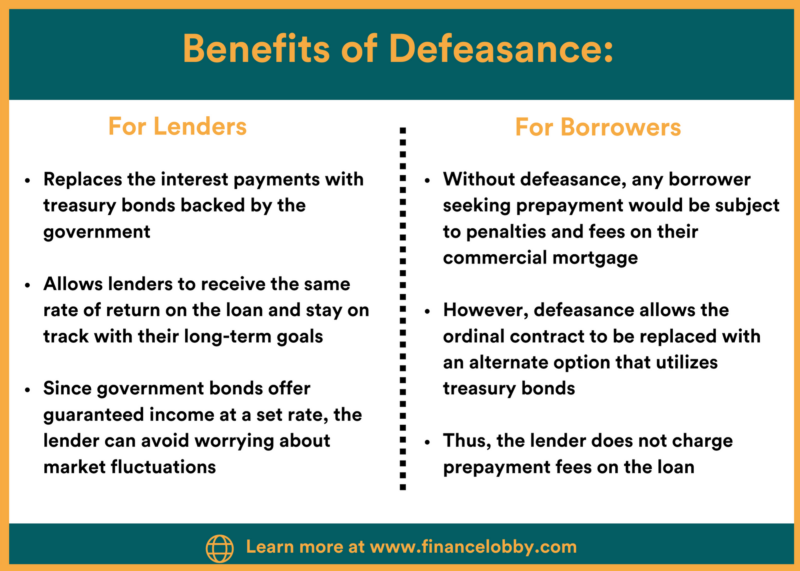

The Benefits for Lenders

Commercial mortgage defeasance offers benefits for both parties involved. A CRE lender is typically willing to make an adjustment on an original mortgage on a commercial property as long as it allows them to meet their own investment goals. As commercial real estate is normally backed by a CMBS, ensuring the lender interest on the loan, they are often opposed to the idea of prepayment, as it can result in the loss of stable income.

Loans have fixed rates and a lender requires and expects that fixed rate of return on any kind of investment. Prepayment can throw them off because they’re losing out on their steady, reliable interest, and even though they may recoup some costs with fees, it can throw off their plans for the long term, and they may end up losing money.

This is where defeasance offers a solution, as it replaces the interest payments with treasury bonds backed by the government. This allows the lender to receive the same rate of return on the loan and stay on track with their long-term goals. Since government bonds offer guaranteed income at a set rate, the lender can avoid worrying about fluctuations in the real estate market; thus, defeasance offers even greater security.

The Benefits for Borrowers

Without defeasance, any borrower seeking prepayment would be subject to penalties and fees on their commercial mortgage. However, defeasance allows the ordinal contract to be replaced with an alternate option that utilizes treasury bonds. Thus, the lender doesn’t charge prepayment fees on the loan.

Another significant benefit for the borrower is flexibility; if a loan is repaid via treasury bonds, the borrower can then sell the property without the lien. In turn, the new owner of the property doesn’t have to worry about the lien, which allows the seller to achieve greater profit on their commercial property.

That same flexibility applies to refinancing a loan as well. When using defeasance, the borrower can take out equity loans or refinance the original loan on the commercial property without the complications of the original loan amount. A new loan might even mean a lower interest rate, or the ability to take out an equity loan on the property to improve the building. This can cover the costs of, for example, a new roof, an updated heating system, renovations, or any other improvements.

While defeasance is considered the most punitive of prepayment options, it’s often less expensive than yield maintenance if rates are close to or higher than the debt coupon.

The Process of Creating a Defeasance Contract

It’s strongly recommended to work with a professional when beginning the process of creating a commercial mortgage defeasance contract. A borrower may choose to use a lawyer, an accountant, or a specialized defeasance consultant. The challenge is to set up a defeasance contract that benefits both parties, the borrower and the lender.

One of the most important benefits of utilizing the services of a professional is the rate of variation in loan agreements, as each lender has different terms, conditions, and standards with defeasance. There are often details about these terms and conditions in the original mortgage document and agreement. Often this original contract will have strict standards about the process of defeasance. It’s important to go through these details with a professional when starting the process of defeasance.

The defeasance contract details the borrower’s options as far as which securities the lender will accept. The contract will also appoint a successor; then the process of defeasance can begin. Lenders sometimes allow the use of agency bonds or other types of bonds rather than treasury bonds, depending on the situation. An experienced professional makes all the difference when creating a successful, mutually beneficial defeasance contract.

What Commercial Mortgage Defeasance Looks Like

In essence, defeasance is the substitution of collateral. When a borrower refinances or sells a commercial property, they use those proceeds to purchase a portfolio of securities equal to the remaining debt service payments required by the loan. Once those securities are pledged to the lender, the real estate can be released from the lien.

This doesn’t pay off the loan, but while the note is still outstanding, it’s assigned from the original borrower to the successor. The new borrower will then make debt payments and cash flow comes from the securities. As mentioned before, experienced professionals are vital in this process. The professionals involved typically involve loan services, attorneys for both the borrower and lender, an accountant who will determine which securities are included in the portfolio, rating agencies, a securities intermediary, a title/escrow company, and the refinance lender or the buyer’s lender.

The final component is typically a defeasance consultant, who will coordinate all involved parties and all essential documents. The process can take a month to complete.

While defeasance has costs, those may be offset by the value of being able to extract equity due to increased property values. Imagine an apartment building or complex, purchased using a CMBS loan, worth $20 million. The loan was likely around 75%, or $15 million. In five years, that property might be worth as much as $30 million. A new buyer could buy the property subject to the existing loan, but it will only have 50% leverage, which may be unattractive to prospective buyers.

The original loan may prohibit repayment, in which case defeasance would allow the new buyer to get a loan with better leverage. So in situations like this, it might be worth the defeasance fees for the original owner to gain the ability to extract equity from the property.

Defeasance vs. Prepayment Penalty

For prepayments, additional fees are charged if the borrower pays the loan off before its maturity date. The total prepayment fee is usually a percentage of the total loan amount, and so with prepayment, borrowers may be paying thousands of dollars in fees alone for wanting to pay off the loan early.

How can defeasance offer a more cost-effective solution? Let’s go back to the case of the apartment building/complex that has increased in value over the course of five years. The current owner wants to sell and is considering defeasance and whether the cost is worthwhile.

The cost of commercial mortgage defeasance can be broken down into two components: the cost of the associated securities, and the transaction fees.

The cost of purchasing securities is a function of the spread between the interest rate on the loan to be defeased and the yield on the securities portfolio on the date the securities are purchased. Once the securities are purchased at closing, the actual cost is calculated.

Transaction fees for a defeasance involve all the fees of the parties that are involved in the defeasance transaction. This would typically include lawyer fees which can involve a retainer, accountant fees, fees for the defeasance consultant, and other costs associated with the involved agencies.

Finance Lobby is an online CRE lending marketplace that is making it faster and more efficient for commercial real estate brokers and lenders to find their perfect deals. To learn more about Finance Lobby, please see https://financelobby.com/.