How to Create Leverage by Refinancing Your Commercial Property Mortgage

If you are the owner of a commercial property, you have likely worked very hard to turn it into a cash-producing asset. Even so, you may still have a CRE mortgage loan that you make payments on each month. Did you know, however, that your commercial property mortgage, while still a debt, can actually give you the ability to buy more CRE properties, ultimately increasing your portfolio and creating wealth for you more quickly?

The ability to turn your commercial loan into a possible source of financial power lies in two key actions: maximizing the revenue that your property is generating and decreasing its expenses, which together maximize the property’s market value. If you can keep this up over the long haul, you will see your own net worth increase as well.

This is where your CRE mortgage loan comes in. The financing you received for your property is just another way of saying leverage, which you can use to increase the potential return of your investment. Be cautious, however, because while commercial real estate values will work to your advantage when they rise, just the opposite can happen if they fall.

How much you can borrow will depend on different factors, including the type of CRE property you already own. Here is what you need to remember: for every dollar you invest, you are able to borrow $1.60-$1.80.

How does that work out? For example, let’s say that you have $125,000 and decide to buy a commercial real estate property for $500,000. That leaves $375,000 that you finance with a commercial property loan. You shop around with commercial lenders and are able to get a decent commercial building mortgage interest rate of 3.25%.

Now it’s time to see if you can maximize your ROI with CRE financing.

Your CRE property, which happens to be a small store, needed some renovations, so you use part of the $375,000 from your commercial mortgage loan to bring it up to code. This was wise because it leads you to more revenue. With everything clicking along, you cut out some extra expenses, and you now have great cash flow.

Back to your loan for commercial real estate. Because you have a $375,000 loan at 3.25% interest for 10 years and a 20-year amortization, your monthly payment is $3,664. When your commercial property mortgage loan is paid off, your payoff balance will be considerable.

The end result, assuming the CRE market stays healthy, is a cash-producing property that is an excellent source of passive income for you.

A word about amortization and commercial property mortgage interest rates

You can save money and build your finances if you first shop and negotiate with commercial lenders for the best terms when refinancing your commercial loan. Lowering the commercial mortgage interest rate by just .5% and increasing the amortization can lower your monthly payment and increase the balloon payment.

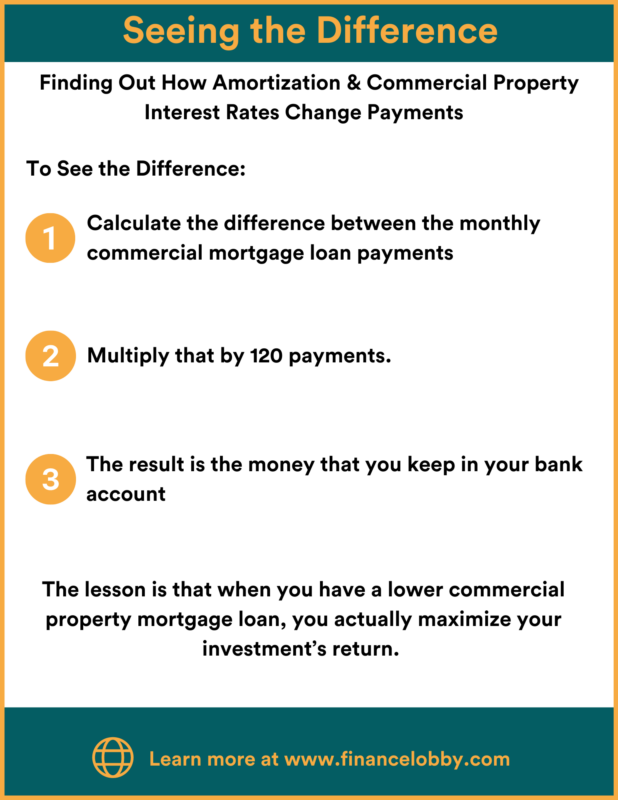

To see the difference, take a few minutes to do this:

- Calculate the difference between the monthly commercial mortgage loan payments.

- Multiply that by 120 payments.

- The result is the money that you keep in your bank account.

The lesson is that when you have a lower commercial property mortgage loan, you actually maximize your investment’s return.

Some suggestions for balloon payments and cash outs

Not everything is perfect: remember that if you lengthen your amortization period to 25 years, you will still have a higher balloon payment regardless of the lower commercial real estate mortgage interest rate. You may be able to avoid this if your commercial property is still generating revenue and operating on minimal expenses. Doing those things means that your property’s market value has been growing and when you pay off the commercial property loan, it should ideally be worth more than it did when you first acquired it.

That being the case, you now have several strategies that can potentially help you to avoid that balloon payment.

Option 1

Your first choice is to simply sell the property and take any profits that result from the sale. It may be the right play, but the caveat is that it is potentially short-sighted. In other words, you are only looking at the immediate benefits of selling the property instead of looking a bit down the road and seeing what else you might do with it.

Option 2

Your other choice is something called a “cash-out refinance.” It basically means that you refinance your commercial real estate property and the commercial property mortgage. The potential benefit is that you may be able to free up the property’s equity, the sum of your initial cash investment and the value that has been created since then.

This could work well for you because with the money, you can acquire more CRE properties or increase the value of the existing property through renovations. The possible drawback is that cash-out refinance loans for commercial properties tend to not give as good of terms compared to those from other types of CRE loans and can have higher interest rates. That said, they should at least be considered because of their potential for increasing the wealth of a successful investor.

Remember that in the case of cash-out funds and the acquisition of new property, you should look closely at the terms of both the new loan that are offered by the commercial lender as well as the original mortgage for commercial property. The end result of your due diligence may be a portfolio of more cash-flowing CRE properties that results in stronger finances.

A few more things to remember when refinancing your commercial loan

When you refinance your commercial building mortgage, you are creating a new option for saving money and increasing the return on your investment.

It comes with additional factors to keep in mind, however. Refinancing a CRE mortgage loan may include the costs of underwriting, staying compliant, and doing due diligence. While you likely already know to scrutinize commercial mortgage interest rates, amortization, the loan-to-value ratio, and other terms, don’t forget about the transaction costs, which will vary from commercial lender to commercial lender. These could include fees for underwriting, legal, title, origination, recording, surveys, environmental testing, and third-party costs for appraisal.

If this is your first time refinancing a mortgage for commercial property, feel free to consult with a loan broker, who can help you navigate the jargon and contracts. While a broker is an investment in itself, working with one may work out to your advantage since you won’t have to spend time making phone calls in search of quotes.

What should you look for in a CRE lender?

All commercial property lenders are not created equally. You will find some similarities, as many CRE lenders offer the same standard, federal, or state loan programs. Others, however, have programs that are designed to fit the kinds of CRE properties or demographics of the clients they want to engage with. Some will offer higher interest rates while others may give fixed rates.

When refinancing your commercial mortgage loan, you will have a variety of commercial lender options, including private money lenders, credit unions, and banks. Take your time in choosing the right one since the more your goals and terms match the lender’s, the smoother the refinancing process will be.

Below is a list of factors that you should keep in mind as you look at your lender options:

- Loan size

- Property location and type

- Your borrowing history

- Your net worth

- Liquidity

As you look for commercial lenders, you will find out very quickly that there will be a lot of competition for your commercial loan. You may be tempted to go with the commercial lender that is the flashiest or has the most advertising. Again, it can pay to go slowly and look at small as well as big CRE lenders. Big CRE lenders may have the money to spend on marketing, but it’s the commercial building mortgage terms that count. Small commercial property lenders can sometimes negotiate terms that are more flexible than those of larger institutions and that may not offer high interest rates or fixed rates.

The takeaway for people who are refinancing a commercial property mortgage

Whether or not refinancing a commercial property loan is the right move will depend on a variety of factors that should be carefully considered before you proceed. It has the potential to save money and allow you to renovate your CRE property, possibly increasing your ROI. It also gives you the option of cashing out so that you can purchase new CRE assets and increase your portfolio.

The key to success will involve making certain that you compare your business goals with the terms you get from the CRE lender. Remember to shop around when refinancing your commercial real estate mortgage and compare commercial property mortgage interest rates, your credit history, and offerings from commercial lenders. Consider engaging the services of a CRE broker, who can save you time and hassle and even money in the long run. Above all, never stop learning about CRE financing, as the more information you have, the better your decisions as a commercial property owner will be.

Finance Lobby is an online CRE lending marketplace that is making it faster and more efficient for commercial real estate brokers and lenders to find their perfect deals. To learn more about Finance Lobby, please see https://financelobby.com/.