Deduct Interest on a Commercial Property Loan and Other Great Tax Savings

Commercial real estate taxes have the potential to drain the finances of even the most prepared investors. Pair this with the potential interest on a commercial property loan, and things can get messy fast. Savvy investors ensure they understand tax obligations and have a plan to tackle them. However, it’s just as important to understand the tax benefits and breaks available. Knowing where you can save will help you navigate those expenses and may even help to remove the stress of overdue taxes altogether.

Thankfully, there are many options to help ease the financial burden of tax rates and interest on a commercial property loan. There are also some pretty surprising deduction options. For instance, learning about commercial investment offers tax savings. You can deduct the cost of travel, lodging, and even dining if you attend a seminar or conference on the subject.

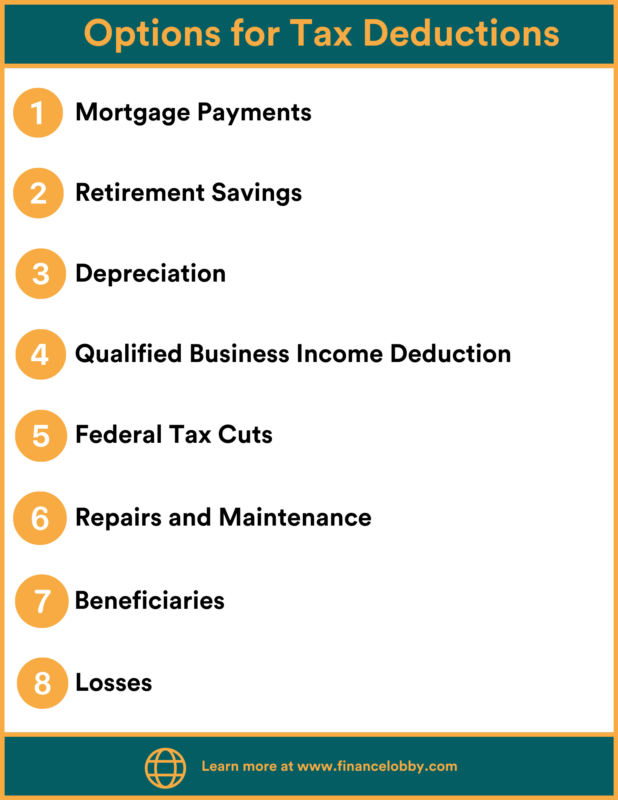

These minor cuts go a long way, especially as you reach higher income brackets. Some of those options require further financial advice from professionals, but there are a few you should know about to ease stress as soon as possible. There are also options for more significant tax deductions, such as:

- Mortgage Payments

- Retirement Savings

- Depreciation

- Qualified Business Income Deduction

- Federal Tax Cuts

- Repairs and Maintenance

- Beneficiaries

- Losses

- Opportunity Zones

- Deduct Interest on a Commercial Property Loan

In this article, we’ll break down the options available for reducing the cost of taxes on your business profits and how to find the deductions that work best for you.

Deduct Your Mortgage Payments

Your mortgage is the first area to explore when investigating tax-deductible options. Many people know that you can deduct your home mortgage interest payments from your taxes, but did you know that commercial mortgage interest payments are tax-deductible? Does your mortgage have a high-interest rate? Your interest may even be high enough to offset any taxes owed on profits you earn from your commercial property.

Deducting mortgage payments is also one of the easier ways to save money on tax deductions. To save this way, take your monthly interest payment according to your mortgage contract and multiply it by 12. When tax time comes around, deduct that number, and you’ve made your first deduction. If you’re paying 2,000 a month in interest, you’ve deducted 24,000 from your taxes.

Use Your Retirement to Save

Tax deductions for commercial real estate might be an appealing reason to look into investing in a commercial property for retirement. Traditional IRAs are taxed at a higher personal rate, but capital gains from the sale of a commercial property tend to be taxed at a better rate. This deduction is especially beneficial for early retirement investments. The longer you own the property, the more you can take advantage of the benefits when retiring. While this isn’t exclusive to retirement, it can be a way for business owners and investors to have backup assets.

Depreciation

One excellent tax deduction for commercial real estate properties is deprecation. All properties, big and small, suffer an overall decline. Investors may qualify to offset the taxes owed with the amount claimed in depreciation.

Investors are allowed to claim depreciation for wear and tear over 39 years. Over those 39 years, the calculated cost of depreciation increases and, in some cases, may even result in being able to deduct the cost of the entire property value from taxes.

Companies can also hire engineers to perform a cost depreciation study for a shorter period of time. Those studies are then submitted to the IRS for a faster benefit for investors. There is also the option of bonus depreciation deductions. These types of deductions resulted from more recent changes to tax laws that allow businesses to add deductions to properties purchased in the first year for the depreciation value. This is meant to be a way for companies to claim a percentage of depreciations well before the 39 years, which is beneficial to economic growth.

Depreciation of properties can lead to the need for extra expenses, and some of these expenses can also be deducted from your taxes.

Qualified Business Income Deduction

Section 199A of The Tax Cut and Jobs Act of 2017 covers the QBI deduction, or the Qualified Business Income Deduction. It is a tax cut for 20 percent of business income that meets the qualifications and another for 20 percent of real estate investment trusts (also called REIT dividends) that meet qualifications. It may be best to talk to an expert to understand what qualifies for deductions with the act. For example, income from the rental property will be eligible while selling that property will not.

QBI deductions aren’t the only helpful tax codes for commercial real estate. Section 1031 is an IRS tax code that allows investors to swap properties without claiming a taxable gain. This is called a ‘like-kind exchange’. It’s a great way to avoid the high taxes you might face when selling a property. This method only works if the property has a value equal to or greater than the other and has no use limit. If you plan it out correctly, you can avoid those taxes time and time again by swapping your real estate instead of selling it.

Repairs and Maintenance

Much like with deprecation, writing off repairs and general upkeep of your property helps alleviate tax burdens. Most of the work done on a commercial property can be written off, including:

- Repairs and property upgrades

- Condo fees

- Renovation Costs

- Building maintenance fees

It’s important to note that tax deductions for renovations only apply as the renovations depreciate. To deduct fees, investors must use the property for work. An investor can live on the property to qualify for the deduction in some cases.

Pass Real Estate on to Beneficiaries

Another option is never selling or exchanging your real estate and instead passing it on to beneficiaries. If you plan to use this approach, don’t worry – you won’t leave your loved ones with a hefty tax. If they decide to sell, they will only be required to pay the taxes on the increased value of the property from the time that they inherited it. That means that if the value has increased significantly over the time of ownership before inheritance, the beneficiaries can consider that increase only profit.

Tax Credit Programs

The federal government has tax credit programs that can benefit commercial real estate investors. These federal tax credits cover a wide array of situations, such as sustainable development. A few concrete examples are:

- Historic Tax Credits (HTC)

- New Markets Tax Credit (NMTC)

- Low-income Housing Tax Credit (LHTC)

These programs are put into place to alleviate some of the added costs of rehabbing historic buildings, incentivize investors to build affordable housing for lower-income families, and start businesses in those areas.

Opportunity Zones

Similar to the tax credit programs, there are great deductions for commercial real estate purchased in opportunity zones, which were added as a part of the Tax Cuts and Jobs Act. These deductions come with criteria that cover these zones, such as income levels per population density. They offer a plethora of deduction options and even tax exclusions.

One important exclusion is property tax abatements for up to 10 years on commercial real estate under renovation. These opportunity zones were determined based on Census results nominated by Governors so look into your local zoning to find opportunity zones in your state.

Deductions for Covering Losses

The final deduction we’ll go over is for losses. No one wants to experience it, but if you find yourself losing money on a commercial property, there are ways to soften the financial blow. Some losses can be claimed as deductions by factoring in whether the investor works in real estate and their income. The income limit is for yearly income under $150,000, and the loss can be deducted straight from your earnings for income under that mark up to $25,000.

Deductions for Interest on Commercial Property Loan

A substantial tax saving that you should know about is the ability to deduct interest on a commercial property loan. This applies to some of the cuts mentioned above. You can deduct the interest on a term loan as long as you:

- Must not live on the property

- Are the person legally responsible for the loan

- You’ve agreed with the lender to pay the entire loan and all the interest payments.

Tax Payments on Commercial Property Investments Don’t Have to Break The Bank

Some of these commercial real estate deduction options may fit your situation, and some may seem more complicated than their worth. There are many options to save on your taxes and maybe even build retirement income for the future.

The world of commercial real estate investment is rewarding but can prove expensive. Tax deductions help ease the stress that comes with a high tax bill. As you’ve seen in this article, there are numerous ways to transform the many things you do to run your business into tax savings. Explore all the avenues available to you as a commercial investor – savings are waiting to be claimed around every corner.

Finance Lobby is an online CRE lending marketplace that is making it faster and more efficient for commercial real estate brokers and lenders to find their perfect deals. To learn more about Finance Lobby, please see https://financelobby.com/.