DSCR Loan: Everything You Need to Know

While many loans that a CRE investor receives will be based on their income, you will be interested to know that one is based on your property’s cash flow instead: a DSCR loan.

No-income mortgage loans mean that you can qualify for a commercial loan without the inconvenience of providing the commercial real estate lender your tax returns. The benefit for you, the CRE investor, is that you can avoid the hurdles that come with income loans: high commercial tax rates, drawn-out approval processes, and stringent lending guidelines that come with debt service coverage ratio loans.

Obtaining a DSCR loan has the potential to help you expand your CRE portfolio, so let’s look into how it works.

Finance Lobby DSCR Content Library

| Topic | Description |

|---|---|

| The Relationship Between DSCR, LTV, and Debt Yield in Commercial Real Estate | Explains how DSCR, LTV, and Debt Yield metrics are interconnected and influence financing decisions in commercial real estate. |

| DSCR Loan Requirements for Different Types of Commercial Properties | Discusses the varying DSCR requirements for different commercial property types, such as retail, office, and industrial properties. |

| How to Optimize a Property’s NOI to Improve DSCR | Provides strategies for optimizing a property’s net operating income (NOI) to improve its debt service coverage ratio (DSCR). |

| Refinancing and DSCR: What Commercial Real Estate Brokers Need to Know | Offers insights on the refinancing process and how DSCR plays a crucial role in securing favorable loan terms. |

| Government-Backed Loan Programs and DSCR Requirements | Explores government-backed loan programs, their DSCR requirements, and how they can be beneficial for commercial real estate financing. |

| Improving DSCR for a Successful Commercial Real Estate Loan Application | Shares tips for improving DSCR to increase the likelihood of a successful commercial real estate loan application. |

What Is a DSCR loan?

You can think of debt service coverage ratio loans as being a kind of non-qualified mortgage loan for CRE investors. Commercial lenders sometimes use a DSCR, which does not verify income, to determine whether a commercial real estate investor qualifies for a loan.

How Does a Debt Service Coverage Loan Work?

First, let’s look into who may seek a DSCR loan and why. Conventional loans will require that investors present proof of their income via tax returns or pay stubs. So, those documents may not represent a CRE’s true income if they write off their property expenses.

Consequently, a DSCR loan can be attractive because they are relatively easy to qualify for. They are issued based on the cash flow of the property, giving the CRE investor an alternative way to qualify for a commercial mortgage loan.

What Are the Potential Benefits of DSCR Loans?

- The first benefit is that the closing time for a DSCR loan will likely be faster. Most close within 21 days, which is considerably faster than the usual 3-6 weeks.

- Without the need to present evidence of income or employment, the mortgage applicant faces a more streamless CRE loan approval process.

- There are no limits on how many residential properties you can have. Normally if you have more than four, you must apply for a commercial mortgage.

- You will enjoy unlimited cash outs, which replace your current mortgage with a new, larger loan. You are paid in cash the difference between the amount borrowed and the amount you owe on the property.

- Down payments are reasonable but will vary from lender to lender. They can go as low as 20%, though 25% is typical.

- DSCR loans can be a good option for CRE investors with not-so-perfect credit, as a minimum credit score is required.

- With DSCR loans, you have an interest-only option. This means that for a specified period, you will pay only the interest on the loan.

- Real estate investors who are new to the industry as well as those who are more experienced can benefit from DSCR loans.

- If you are an investor in short-term and long-term rental properties, you are eligible for DSCR loans.

- You are not required to have any reserves on cash-out loans. On other commercial loans, you must have at least six months in reserve unless the DSCR ratio is under 1.

What Exactly Is a Debt Service Coverage Ratio?

Simply put, the DSCR is a ratio of a commercial property’s annual net operating income and its annual mortgage debt. This includes principal and interest. Without a CRE investor’s income to judge, lenders will use the DSCR to determine if the income coming from a property can support the new commercial real estate loan. The DSCR can also tell the CRE lender how much income coverage will be at a specific loan amount.

What Kind of DSCR Is a CRE Lender Looking For?

The DSCR required by commercial lenders will vary. Generally, you can expect to encounter a 1.25 DSCR, though occasionally you may find commercial real estate lenders who qualify investors for loans with lower DSCRs. As you would expect, there can be a difference in the terms you receive depending on the DSCR. Ratios that are above 1 usually get better commercial interest rates while those that are less will require reserves.

In the end, it works much like you would expect: no matter what the CRE lender stipulates a good DSCR as being, they are trying to determine how likely it is that the commercial borrower will repay the commercial loan.

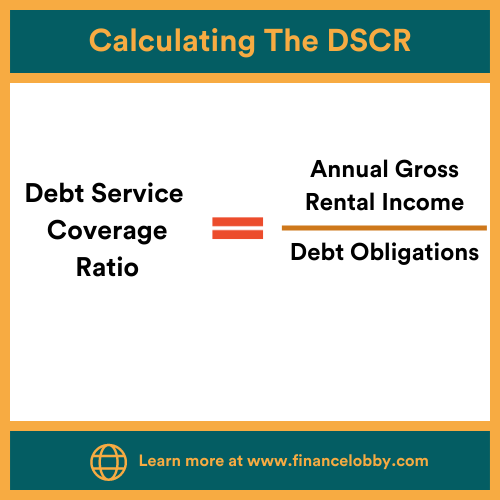

How to Calculate Your DSCR: The Formula

The DSCR is fairly straightforward: you divide your annual gross rental income by the property’s debt obligations.

| Debt Service Coverage Ratio (DSCR) = Annual Gross Rental Income / Debt Obligations |

Let’s break this down into some easy steps so that you can determine your own DSCR and see if a DSCR loan is a good option for you:

- First, determine your gross rental income. The best way to do this is to compare your annual rental income and the appraiser’s comparable rent schedule. Whichever one is less, use that. Sometimes, if you have evidence of at least a year’s worth of rental income, that can help you to qualify.

- Second, it’s time to figure out your annual debt, which is basically your annual interest, principal, taxes, insurance, and Homeowners Association payments.

- Now, to get your DSCR, you will divide your annual gross rental income (#1) by your annual debt (#2).

Remember that when you are trying to qualify for a mortgage, the CRE lender will not look at your Capitalization Rate (Cap Rate), Return on Investment (ROI), Cash on Cash Return (COCR), or Net Operating Income (NOI).

Now Let’s See the DSCR Formula In Action.

Let’s say that you are looking into a commercial property that has a gross rental income of $120,000 and an annual debt of $80,000. If you divide $120,000 by $80,000, the DSCR will be 1.5. This will be excellent in the eyes of the commercial lender because the property is generating 50% more income than what is needed to pay back the commercial mortgage. It is positive cash flow, which always bodes well for the investor.

Why Should Your Debt Service Coverage Ratio Matter to You?

Remember that one small number – the DSCR – can help a commercial lender to judge whether an investor has the ability to make consistent payments on a DSCR mortgage and pay it off.

If, unfortunately, your DSCR is less than 1.0, you may be deemed a commercial mortgage risk. Your DSCR means that your CRE asset may have negative cash flow. If this is your situation, you are not out of luck. It is not unusual for commercial real estate investors to receive a DSCR loan with a ratio that is less than one. Most are issued in specific situations, however, including home renovations or upgrades that may either lead to increased rent or for buildings that could do well down the line.

What You Can Do If Your Debt Service Coverage Ratio Is Low

The lower your DSCR is, the fewer your mortgage options will likely be. Your choices will probably include non-QM mortgages, which might include the below:

- Asset-Based Loans: This is a loan that is secured by collateral. They are often issued to smaller businesses that are experiencing short-term cash flow issues. Without the burden of providing proof of income to qualify, the investor can find these easier to obtain.

- Bank Statement Loans: While some loans require that you present your tax returns as proof of income, with these loans, your income is verified with your bank statements. The potential advantages is that your bank statement may show your actual income as opposed to a tax return, which will reflect your write-offs.

- Interest-Only Loans: These loans can be beneficial for CRE investors who anticipate having cash-flow problems for the short term. Because the investor only pays the interest and not the principal, monthly mortgage payments are typically lower.

- Recent Credit Event Loans: For investors whose credit may have been impacted by recent events, including divorce, short sale, foreclosure, and bankruptcy, a recent credit event loan can be useful. A damaged credit score can hinder an investor’s ability to obtain CRE financing, so this is an alternative, though mortgage rates are usually higher.

The Takeaway for CRE Investors Interested in a DSCR Loan

If you are interested in building your commercial real estate portfolio, the mortgage industry has a financing option for almost every situation. DSCR loans can be perfect for both new and expert investors because of their faster closing times, easier loan approval process, unlimited cash outs, reasonable down payments, and interest-only payment options.

As always, knowledge is power. Keep coming back to the Finance Lobby blog as we continue to post useful information that will help you to navigate the world of commercial real estate financing.

Finance Lobby is an online CRE lending marketplace that is making it faster and more efficient for commercial real estate brokers and lenders to find their perfect deals. Users are able to set their perfect terms and receive notifications of relevant deals. The Finance Lobby platform also enables CRE brokers and lenders to manage soft quotes, deals, schedules, and communication all in one place. It is the solution to days that are spent chasing dead-end leads.

To learn more about Finance Lobby, including how it can help you to spend time on the things that matter the most, please see https://financelobby.com/.