Cost Segregation: A Strategy That Helps CRE Investors Pay Less Taxes

If you are considering investing in commercial real estate, you are likely concerned with how you will handle your taxes. Before you dive into CRE ownership, it’s a good idea to learn how to legally reduce the taxes you owe, potentially saving you money that you can invest elsewhere. All the legalese and related tax law can make your eyes cross, but a few minutes spent learning it is wise.

Below, you will find a great primer on commercial real estate depreciation, multifamily financing, and additional cost segregation factors encountered in the CRE industry.

First, Let’s Define Cost Segregation in Commercial Real Estate.

It’s important to remember that as you plan your taxes regarding your commercial property, you have a significant tool at your fingertips. Cost segregation is basically a tax-deferral strategy that allocates the depreciation deductions for a real estate property to the beginning of the ownership. It is meant to shelter the taxable income of a CRE investor on their commercial properties. This happens through commercial real estate depreciation, or the reduction in value of specific parts of the property. What typically happens is that some parts of the property will depreciate more rapidly than others, ultimately lowering the taxable amount the investor shows on the CRE property.

Understanding the Specifics of the Cost Segregation Strategy Is Important.

You have tax reform to thank for the potential benefits of accelerated depreciation and cost segregation. As you immerse yourself in the terms and rules, a cost segregation study can help you to understand why the strategy is beneficial, but be sure that you know how it really works. When you are comfortable with it, that’s when you can maximize any benefit you get from working with depreciation.

Depreciation Can Be Very Useful to the Commercial Real Estate Investor.

As your CRE property investment depreciates over time, its value will be reduced. This is only natural, as it will undergo a lot of wear and tear over the years to come. It is also possible that as new technology is introduced or aesthetic preferences change, your property may depreciate as well. The standard formula for depreciating the value of a CRE property is to divide the property’s value by 27.5 years. That depreciation expense is then deducted from the pre-tax net income that the property generates.

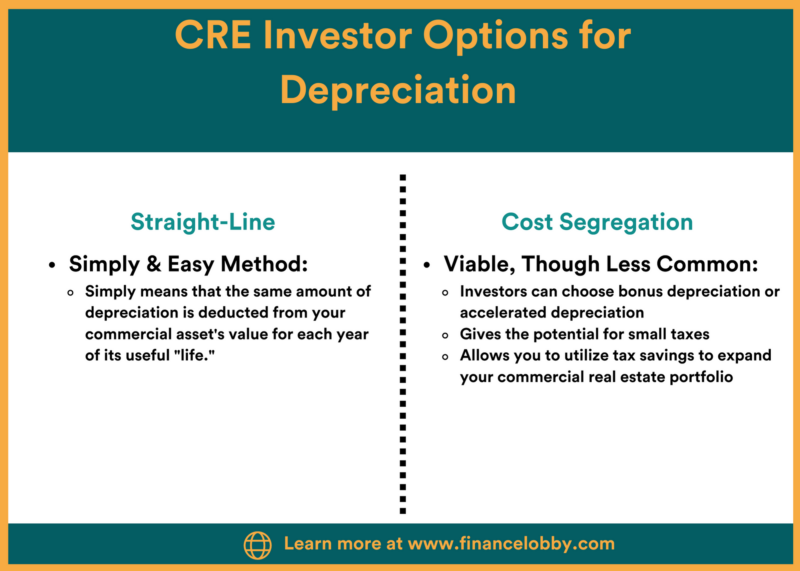

CRE Investors Have Two Options For How Quickly Their Commercial Properties Will Depreciate.

It is likely that you will choose a “straight-line depreciation,” the easiest way to determine your commercial property’s depreciation over time. It simply means that the same amount of depreciation is deducted from your commercial asset’s value for each year of its useful “life.”

The other option is viable, though less common: through cost segregation, CRE investors can choose bonus depreciation or accelerated depreciation. Why would this be preferable to straight-line depreciation? It gives the potential for small taxes. You could then use the tax savings to expand your commercial real estate portfolio.

A Cost Segregation Study Can Be Valuable for a CRE Investor.

First, a cost segregation study can be very useful because it helps you to see your CRE investment as being composed of different categories instead of being one big property. By looking at each component, you can get an accelerated depreciation timeline for some of them and really see your investment more realistically.

If you have a commercial property, you can perform a cost segregation study on it. The possible benefit is that by doing so, you will be able to convert your property into a different type. Most commercial real estate properties are classified as 1250 properties, which include commercial buildings and residential rental properties. Once you complete a cost segregation study, it is possible that some of your property’s components could be converted into 1245 property, which includes all depreciable and tangible personal property, such as furniture. The result is a possible acceleration of depreciation for components over a timeframe of up to fifteen years.

Why is this a potential benefit for you? The usual depreciation schedule on a commercial property is 39 years. If you convert your components into 1245 properties, you have now got a larger depreciation that can be written off. An accelerated depreciation rate on an investor’s commercial property ultimately equals a lower income tax rate.

That, in turn, can make the property more profitable, all because you legally avoided the higher tax rates associated with regular depreciation. So, what will you do with the extra money?

A Cost Segregation Study Is Conducted By Professionals.

Before you break out your pen and paper and start looking at the components of your property, remember that you will need a professional to conduct your cost segregation study. Also, your property may or may not be the right fit for tax breaks that come from accelerated depreciations, so it is wise to get the assessment of a professional. Typically, the CRE properties that are ideal are those that include multifamily financing or those that are very large.

The person who conducts your cost segregation study will likely have a background in architecture, engineering, construction, and accounting. They may be able to advise on whether your components can be changed into a 1245 property, including your heating or A/C system and carpeting.

The person will look at things that typically depreciate faster, including lighting, ventilation, the foundation, plumbing, pipes, and storage tanks. Once the cost segregation study is completed, you can use the results to determine if you would like to switch your components over to 1245 properties. In doing so, you may be able to lower your taxes – legally.

Now the Bad News: Cost Segregation Studies Aren’t Cheap.

Reduced taxes? You knew there had to be a hitch – to conduct a cost segregation study, you will have to shell out up to $15,000. It is a lot of money, which explains why the majority of studies are conducted on larger CRE properties. It really comes down to how much federal income tax you are likely to save on – residential and smaller CRE properties will probably skip the cost segregation studies while larger properties, such as those that are multifamily, may benefit from them.

So, before you decide whether to get a cost segregation study, consider how much revenue your commercial property is already generating and whether it would make a noticeable difference in your tax return. If so, then have the study done.

The Timing of a Cost Segregation Study Can Be Important.

It only makes sense that you should have the cost segregation study done either when you purchase or develop the property or at least within the first year. You don’t, after all, want to wait until your property and its components have developed problems and depreciated to have the study done.

Legislation That You Should Keep In Mind

The Tax Cut and Jobs Act is important to remember as you decide whether cost segregation is right for you. Passed in 2017 and added to the IRS code, it allows business owners like you to take bonus depreciation, a tax incentive that allows a business to immediately deduct a large percentage of the purchase price of eligible assets, such as machinery, rather than write them off over the “useful life” of that asset.

How big is this bonus depreciation? In their first year, 100% for qualified assets. Remember, though, that those assets are determined through a cost segregation study.

Act fast! While the bonus depreciation replaces depreciating the assets over time as usual, it won’t be available past 2022, when the IRS will begin to phase it out and remove it by 2027. So, if you think this could be an option for you as a commercial real estate investor, now is the time to jump on it.

As noted, the cost segregation study is so pricy that most investors who can benefit from it will be those with larger properties. The bonus appreciation with the IRS can make the hassle of conducting the study worth the expense.

As you go deeper into the world of commercial real estate, keep one eye on the taxes that you pay. By legally reducing your tax burden, you may save considerable money that you can then reinvest into other CRE properties. To lower your taxes, consider hiring a professional to conduct a cost segregation study on your commercial property, and remember to see if you will benefit by adjusting the depreciation on your CRE assets. Lastly, remember 2027 – that’s when the bonus depreciation will be phased out, so remember to take advantage of it while you can.

Finance Lobby is an online CRE lending marketplace that is making it faster and more efficient for commercial real estate brokers and lenders to find their perfect deals. Users are able to set their perfect terms and receive notifications of relevant deals. The Finance Lobby platform also enables CRE brokers and lenders to manage soft quotes, deals, schedules, and communication all in one place. It is the solution to days that are spent chasing dead-end leads.

To learn more about Finance Lobby, including how it can help you to spend time on the things that matter the most, please see https://financelobby.com/.