The Gross Rent Multiplier: How to Calculate It and Use It

Sometimes it is very easy to tell if one rental property will be a better investment over another – after all, you aren’t going to buy the one that sits next to a landfill. However, it gets a lot trickier when both properties appear to be equal on the surface. For these situations, veteran CRE investors and newcomers both turn to the gross rent multiplier or GRM. The GRM is a financial metric that can help you select the best rental property to invest in and even keep track of the real-time financial performance of a property you already own.

Below, you will find some useful information on how the gross rent multiplier can help you invest more wisely in commercial real estate and how it differs from the cap rate.

First, What Is the GRM?

Simply put, the gross rent multiplier is a formula that can help you determine the potential profitability of a property. You can then compare similar properties and more accurately determine which one may make the better CRE investment. It is especially useful if there is a lot of fluctuation in the market, with rents changing rapidly.

How is the Gross Rent Multiplier Calculated?

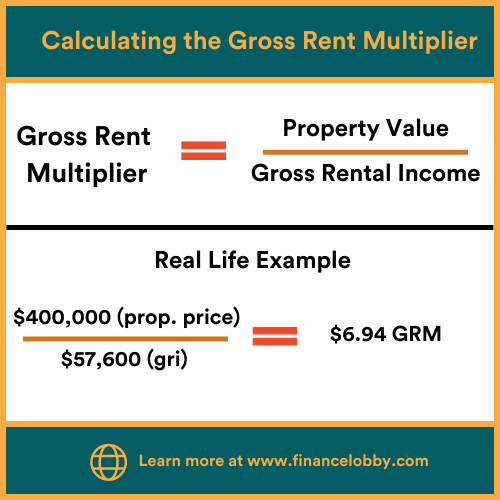

For those of you who weren’t fans of math class back in school, you will have no worries here. The formula for determining the GRM is really pretty simple:

| Gross Rent Multiplier = Property Price or Value / Gross Rental Income |

That’s it! Now let’s look at how calculating the GRM works in practice.

A Real-Life Example of Calculating the Gross Rent Multiplier

Let’s say that you have a four-unit multifamily property. Your CRE property is generating a gross annual rent of $57,600, and the asking price for the property is $400,000 per unit. So, to calculate the gross rent multiplier ratio, you would do this:

| $400,000 (property price) / $57,600 (gross rental income) = 6.94 GRM |

What Is a Good GRM?

So, what’s a good number to have when you calculate the gross rent multiplier? Remember that it’s all about comparing CRE properties to determine which one is the best investment. Accordingly, if all you have is one number, it doesn’t really mean anything, correct?

Since it’s all about comparisons, then, most investors say that the lower the GRM is compared to that of other similar properties in the same market, the better the investment probably is. A lower gross rent multiplier means that the commercial real estate property is generating more gross income and at a faster rate compared to other CRE assets.

What Are Some Other Uses for the GRM?

If you know at least two of the three variables in the equation, then you can determine the other. The GRM, therefore, is useful for calculating the property’s price or its gross rental income.

Let’s see how that works out.

If you have a market GRM of 8.2 and the asking price of the property is $550,000, then this is how you would calculate the gross rental income:

| $550,000 (property price) / 8.2 (GRM) = $67,073 (gross rental income) |

A quick primer on formulas:

- Gross Rent Multiplier = Property Price/Gross Rental Income

- Gross Rental Income = Property Price/Gross Rent Multiplier

- Property Price = Gross Rental Income X Gross Rent Multiplier

How the Gross Rent Multiplier Differs From the Cap Rate

The GRM and the capitalization rate (cap rate) are different. Let’s look at the nuances between the two:

- The gross rent multiplier estimates the value of a rental property based on the gross rental income that it generates.

- The cap rate calculates the current value of a property or what it should be based on the net operating income (NOI) an investor receives.

It is important to recognize that the net operating income does not include any mortgage payments made on the CRE asset. NOI only includes regular operating expenses. The cap rate does not include the debt service because in order to make a more accurate comparison since how much leverage that any CRE investor uses will differ.

How to Calculate the Capitalization Rate

You may have heard of the 50% rule in real estate, which states that 50% of the gross income generated by a rental property should be allocated to operating expenses. It’s a good way to avoid getting into trouble by underestimating your expenses and overestimating your profits.

What that means is that if your CRE property has a gross rental income of $75,000 annually, the NOI will be roughly $37,500. To get the capitalization rate, you divide the NOI by the property’s value or purchase price, which we will say is $500,000.

| $37,500 (NOI) / $500,000 (property’s value) = .075 or 7.5% cap rate |

Just like with the gross rent multiplier, the capitalization rate needs to be compared to other cap rates for it to have meaning. When cap rates are compared, the one that is higher is likely better because the potential return is higher.

The Gross Rent Multiplier vs. the Capitalization Rate

It is important to remember that both represent potential value, just differently. Keeping in mind the cap rate calculation, the higher the cap rate, the more profitable a property is likely to be. And with the GRM calculation, the lower the GRM, the higher the potential profit.

During these tough economic times, rents are being raised all over the country, so this is a perfect example; let’s take a look at rates both before and after a rent increase of 6%.

- Before:

GRM: $400k property value / $53,333 gross rental income

= 7.5

- Cap rate = $26,667 NOI / $400k property value

= 6.7%

- After:

GRM: $400k property value / $56,533 gross rental income

= 7.087

- Cap rate: $28,267 NOI / $400k property value

= 7.1%

After the rent increase, the gross rental income saw a 6% increase. Based on the 50% rule, the NOI increased from $26,667 to $28,267.

How to Apply the Gross Rent Multiplier

The practical application of the GRM is that you can utilize this calculation to estimate the value of revenue that a property will generate. You can example two similar properties with a comparable market value, but whichever has a lower GRM will offer the best value, as the gross rental stream is greater.

Also, if you own a rental property, you can use the GRM to monitor any changes in value based on the gross amount of rent being collected. For example, if your property has a lower GRM than a neighboring similar property, that’s a good indication that your property manager is collecting rental payments on time and keeping turnover low. The lower the tenant turnover rate is, the less rental income is lost.

But if your GRM is higher than other similar properties, you may need to consider taking action; for example, you may need to see if your property has an unusually high turnover rate, if your property manager is not collecting rental payments on time, or if you need to consider raising the rent.

Some property owners worry about losing tenants (increasing tenant turnover) by raising the rent, but typically renters will not opt to move out based on a fair market rent increase. As long as you’re charging fair market rates, if you do lose tenants, you’ll be able to easily replace them.

Pros and Cons of the Gross Rent Multiplier

There are several key advantages and disadvantages to be aware of when using the GRM.

Pros of Using the Gross Rent Multiplier

- Simple calculation that makes it easy to compare the value of multiple similar properties

- An easy formula that can help new rental property investors calculate property value

- Solid screening tool to determine the value of a potential real estate investment opportunity

- Focused on actual rental income generated rather than merely the value of the building or the price of each individual unit

- Both the seller and the buyer can use the GRM to value property

Cons of Using the Gross Rent Multiplier

- The GRM does not take into account any operating expenses

- Sellers may try to use a low GRM as a major selling point (ie., drive the price up) for a property that has a lot of costly deferred maintenance

- Potential buyers may overlook deferred maintenance in favor of a low GRM and end up spending thousands out of pocket for repairs

- GRM does not factor in the cost of vacancies causing lost rental income (keep in mind that a poorly maintained property may take longer to rent and may not attract responsible tenants)

- The GRM does not measure the amount of time needed to pay off a property; this is a common misconception as the GRM only compares gross rental income to the actual property value

When using the gross rate multiplier, it’s important to recognize what it does and what it does not do. As long as a potential investor or buyer is aware of the limitations of this calculation, it can be extremely useful because of its speed and utility.

As the GRM does not calculate operating expenses, a potential investor/buyer should spend time investigating what those operating expenses are going to be for any given property. For example, rental properties in northern states will have extra expenses during the winter months for snow removal, salting icy sidewalks, and ensuring that all buildings are winterized. None of these expenses are calculated in the GRM, so while it’s a helpful tool, it’s not the end-all, be-all when it comes to determining whether a property is a good investment.

Finance Lobby is an online CRE lending marketplace that is making it faster and more efficient for commercial real estate brokers and lenders to find their perfect deals. Users are able to set their perfect terms and receive notifications of relevant deals. The Finance Lobby platform also enables CRE brokers and lenders to manage soft quotes, deals, schedules, and communication all in one place. It is the solution to days that are spent chasing dead-end leads.

To learn more about Finance Lobby, including how it can help you to spend time on the things that matter the most, please see https://financelobby.com/.