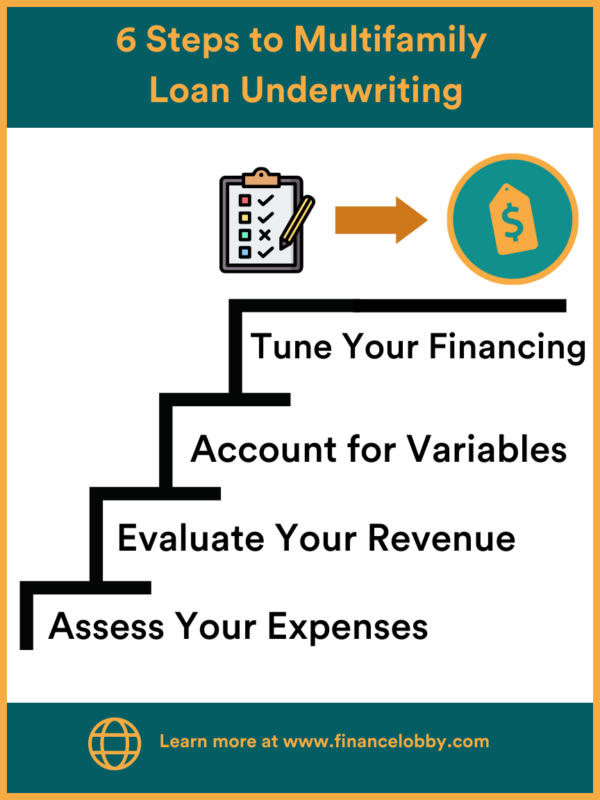

6 Essential Steps to Multifamily Loan Underwriting

Underwriting is often thought to be much more complex, arduous, or confusing than it actually is. In reality, underwriting for multifamily loans can be a simple, step-by-step process of evaluating the expenses and profits that you currently have and will have in the future. This can be broken down into several stages for the sake of simplicity and ease, allowing you to complete the underwriting process at a manageable pace and avoid getting confused along the way. With this guide, we hope to shed some light on the most important parts of multifamily loan underwriting and provide beginners with a broad look into this essential process.

Ideally, the multifamily loan underwriting process should be completed in order, but you often discover pieces you may have missed at earlier stages later down the line. The most important thing is to keep yourself on track and stay organized.

The first (and arguably most fundamental) phase of the multifamily loan underwriting process involves getting intimately acquainted with the money coming in and going out of your property. You’ll need to take a thorough and comprehensive look at your records to accurately project your post-loan costs and cash flows.

#1 – Assess Your Expenses

First thing’s first: we need to get to the bottom of your current and anticipated costs. This requires a high degree of foresight, as you’ll want to account for your expenses for the expected duration of your ownership of the property. To begin, you will need to carefully comb through the past year of expenses to create an accurate picture of your expected cash outflows for the next year of ownership.

There are a wide range of expenses you may not often think about that nevertheless must be included in your financial planning. This includes both routine and rare (but predictable) costs of maintaining units, services, and amenities, as well as unexpected costs that can arise while properties are unoccupied. You’ll also need to stay on top of recurring expenses such as taxes, utilities, and insurance. Assessing your insurance costs is a great time to reevaluate whether or not your coverage is comprehensive enough.

Take the time to dig deep on this one; it’s best to include everything. Don’t be afraid to confront the expenses that trouble you.

#2 – Evaluate Your Revenue

Now for the good stuff: assessing your revenue and other profits from the property. To assess the many potential sources of income associated with a property, it’s recommended to start with a thorough look at your rent roll. How much are each of your tenants paying in rent and other fees, such as pet rent, covered parking, garages, storage spaces, or any other amenities you provide? With these other potential sources of revenue from the property, do you feel comfortable with the current base rent rate? This is a great time to evaluate many aspects of your property and management style.

As in the previous step, set aside ample time to think of all the profits you bring in. If you hope to accurately project your returns, make sure to account for all the possible sources of income you have. Even vending machines can earn a steady profit!

#3 – Account for Variables in Your Financial Model

We enter now into the realm of educated guesses and calculated predictions. There are several factors you need to account for in your financial model that are not as concrete or clear-cut as rent rates and parking fees.

Renovation Costs and Adjusted Rent

- Multifamily investments often include plans or agreements regarding potential renovations to the property, from the units themselves to the many shared spaces and amenities.

- Depending on the scale and extent of the planned renovations, this can be a significant expense that must be included in your model.

- As renovations increase the quality and value of a property, it’s only natural for rent rates to increase. You must take care to accurately estimate your projected rent (assuming renovations are completed on budget and on schedule) and account for it in your financial planning. This can have a major impact on your ROI.

- The timeline of your renovations is another factor at play in the estimation of your expenses and returns. Consider every factor in your calculations and analysis; if it seems important, it probably is.

Growth Rate

- At this stage, you’ll need to consider market rent increases over time.

- Remember that rent is almost always increasing. In the past few years, we have seen rent prices soar across the nation, and it may continue to rise over the next decade. Rent today may be half what it is a year from now, and one-tenth what it will be in five years.

- Analyze rent increases in your local market to determine a stable, reliable growth rate that you can include in your financial model.

- While reviewing a deal, it is recommended that investors be able to account for at least the next 6-8 years of expected growth (depending on the planned duration of your ownership).

Occupancy and Vacancy Rates

- You can’t always count on a property to stay full. Even properties that haven’t seen a vacancy in years simply have no way of knowing or guaranteeing that they stay that way.

- Market trends, competition, management style, and a multitude of other factors can impact your assumed vacancy rate.

- Analyzing the past year(s) of your occupancy and vacancy rates can give you a clearer picture of what to expect in the future, but the market can change quickly.

- Renovating your property can increase demand, but falling behind on renovations (or renovating poorly) can negatively affect your occupancy rate.

- Remember that these calculations will not reflect major world events or macroeconomic factors that can unexpectedly impact the market.

#4 – Fine-Tune Your Financing

If you don’t have enough cash on-hand to buy a multifamily property outright, don’t worry – you’re not alone. The vast majority of multifamily property investments (and commercial real estate investments in general) are purchased by taking on debt. If you’re financing a CRE property deal with debt, incorporating that debt into your financial modeling will be critical to correctly estimating your revenue and expected returns on the deal.

This stage requires some careful calculations. The loan amount, interest rate, amortization term, and any interest-only terms should all be factored into your planning. You should also account for any potential refinancing you expect over the next several years. This stage is your chance to prepare in advance and ensure that the financing process goes as smoothly as possible.

#5 – Reevaluate and Review

After digging through a blinding-white mountain of bills, statements, and other records. This stage gives you a chance to pause, take a step back, and look at everything you’ve gathered from a new perspective. The final stage of the process involves performing a final review and reevaluation of every feature of the underwriting deal you’ve included thus far. Is there any element you left out at any stage of the process? With all of your projections made, how do you feel about the terms of the deal? It’s important to be honest with yourself and confront any concerns you may have at this stage.

#6 – Name Your Price

When you’ve completed your projections, the next step is to set a price for the property that aligns with those estimates. The price should correspond to your desired internal rate of return. It is sometimes necessary to adjust a price based on assumed rates of growth or return over the intended hold period, so make your calculations carefully: this may be one of the most important stages of the multifamily loan underwriting process.

Multifamily brokers often receive multiple offers for the same property, and among those offers, they often find a wide range of sums. This usually boils down to a difference in expectations, assumptions, and confidence that informs an investor’s willingness to pay.

Final Advice: Trust the Process

The prospect of underwriting can be intimidating, but as we hope to have shown, the actual stages of the process are much more understandable and manageable than you may have heard. Though gathering all the information you need can seem a monumental task at first, exercising patience and diligence at each stage of the process will only serve to benefit you in the long run. Taking care to gather all the information you need to make accurate projections and form sound conclusions will help to ensure that your multifamily loan underwriting process goes over smoothly and results in strong returns.

With a basic level of organizational and mathematical skills, almost anyone can make it through this process. If you follow these six simple steps, you’re sure to enjoy an efficient and successful underwriting experience.

Finance Lobby is an online CRE lending marketplace that is making it faster and more efficient for commercial real estate brokers and lenders to find their perfect deals. Users are able to set their perfect terms and receive notifications of relevant deals. The Finance Lobby platform also enables CRE brokers and lenders to manage soft quotes, deals, schedules, and communication all in one place. It is the solution to days that are spent chasing dead-end leads.

To learn more about Finance Lobby, including how it can help you to spend time on the things that matter the most, please see https://financelobby.com/.