CRE Loans: What Are the Differences Between the SBA 504 and the SBA 7(A)?

Getting started in any business is a pricey endeavor, and real estate investing is no different. It’s crucial to figure out your financial options as early as possible – the need for better cash flow and more access to working capital is a constant one for small businesses. Banks only offer so many options, however, and it can be hard to find all the available opportunities for your business, especially with favorable CRE rates. Thankfully, there are CRE loans that can help ease the financial burden via The Small Business Association (SBA). They offer commercial real estate loan options that you should have on your radar (even if you don’t need it right this second): SBA Loans.

SBA Loans are excellent solutions for small businesses, and there are two you should consider for your needs: SBA 504 CRE and SBA 7(A) CRE. The type of loan your company benefits from the most will vary based on several factors, including:

- Your purpose for the money

- The size of your business

- Whether or not the money is for purchasing large assets

This article will break down the differences between these two commercial real estate loan options and help you understand which is better for your situation.

What are SBA 504 CRE Loans?

The SBA 504 CRE loan program, also called the Certified Development Company program, is meant to help businesses finance the purchase of fixed assets at lower CRE rates than market value. Those assets can be large machinery or commercial properties, such as large office buildings or warehouses at below-market rates. These CRE loans are distributed in percentages to three participants:

- A borrower (a minimum of 10 percent)

- A bank (50 percent)

- The nonprofit Certified Development Company (CDC) at 40 percent

This practice is called the 50-40-10 model. There’s also the option for the borrower to put down a higher percentage, which adjusts the model. The loan amount can vary significantly depending on your needs. Loan amounts start at a minimum of $125,000 with a maximum that can go over 20 million dollars.

The SBA 504 loan is best suited for businesses hoping to expand to a new building or move offices or companies adding new departments or building additions that require expensive equipment or heavy machinery. One example of a qualified borrower would be someone starting or expanding for landscaping or construction. It also proves effective for businesses expecting a significant return on investment, such as through the purchase of a fleet of trucks. For commercial real estate, this comes in handy quickly.

What are the qualifications for an SBA 504 CRE Loan?

The SBA 504 CRE loan qualifications are straightforward:

- Your business’s network cannot exceed 15 million.

- The business’s two-year average net profit (after taxes) cannot have exceeded $5.0 million.

- The owner must occupy at least 51 percent of the purchased building.

- For loans needed for equipment, that equipment must have a 10-year useful life.

The purchased assets can serve as collateral for the loan.

What are SBA 7(A) CRE Loans?

The SBA 7(A) loan is a CRE loan with the primary purpose of funding an expansion or renovation. It’s much smaller in scale than the SBA 504, carrying a minimum of 50,000 dollars and a much lower maximum borrowing amount of 5 million dollars.

SBA 7(A) loans are backed by a private lender and a contribution from the Small Business Administration. This loan is a better fit for a business if they aren’t just making real estate moves with the loans. These loans work great for working capital, typically having the shortest loan period.

If used to purchase equipment or a business, the funds can have a loan period of 10 years. The longest period, 25 years, is reserved for specific types of real estate investment.

These loans can be hard to qualify for and require a 10 percent down payment but remain highly sought after due to their favorable commercial real estate terms and great variable interest rates.

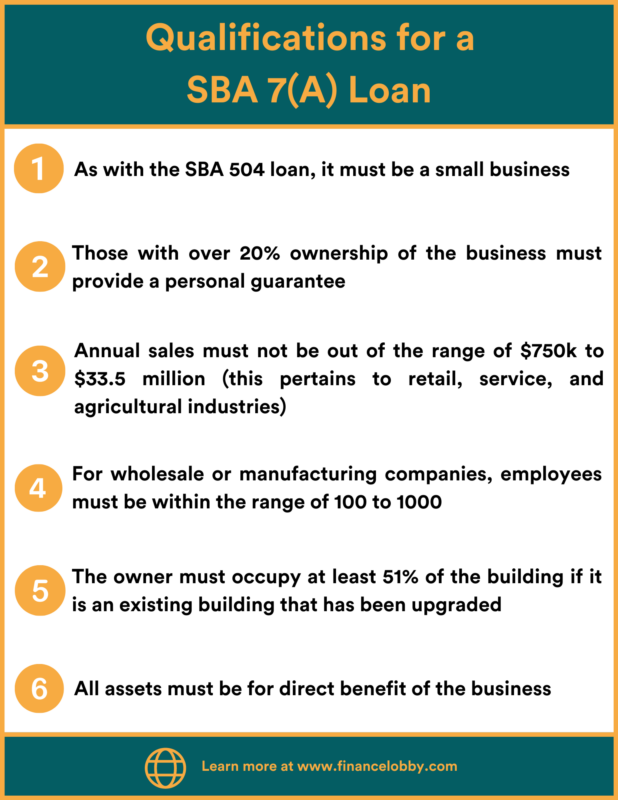

What are the qualifications for an SBA 7(A) Loan?

The difficulty in qualifying for an SBA 7(A) CRE loan varies by industry. However, some rules of thumb can help break the specific rules down. Overall, there are quite a few requirements for applying for SBA 7(A) loans, including:

- As with the SBA 504 loan, it must be a small business.

- Those with more than 20% ownership of the business must provide a personal guarantee.

- Annual sales must not be out of the range of $750k to $33.5 million (this pertains to retail, service, and agricultural industries)

- For wholesale or manufacturing companies, employees must be within the range of 100 to 1000.

- The owner must occupy at least 51 percent of the building if it is an existing building that has been upgraded or renovated.

- If the loan supports new construction, the owner must occupy at least 60 percent of the building.

- All assets must be for the direct benefit of the business.

- The borrower’s residence will be pledged for the loan unless proven unnecessary by the bank.

The differences between the SBA 504 CRE and SBA 7(A) Loans

While both the SBA 504 CRE and the SBA 7(A) are loans offered by the Small Business Administration (SBA), they have significantly different advantages. Outside of the apparent differences, certain aspects of each loan make them incompatible with certain business types.

Overall, the SBA 504 CRE loan’s structure and scale are larger than its sister loan, and for some, these structural differences will make finding the perfect fit easy. If your project is massive in scale, this loan offers enough money to cover the costs in most cases. On top of the broader cost coverage, Certified Development Companies have been set up to help facilitate economic growth, and many of them are found nationwide.

On the other hand, the SBA 7(A) is meant to serve those looking for increased working capital. It is a program created by the Small Business Association to help support small businesses first and foremost. While this loan can be used to purchase large equipment or real estate, it can also be used for repairs, renovations, payroll, etc., and usually for a much smaller amount, closer to 5 million. The SBA 7(A), for this reason, becomes the primary choice for businesses needing less money but more options.

How do you decide between the two CRE loans?

The most significant deciding factor for these loans is simple: cost and purpose. How will your business use the money, and how much money do you need? There are benefits to each loan that make the ultimate choice obvious for your specific situation, so doing in-depth research is vital here. Something that is an absolute deal-breaker might catch your eye, while something else might make the decision easy.

Urgency and timeline are also crucial factors to consider. How urgent is your financial necessity?

To get the most out of either of these loans, you should consider a few key details. Ask yourself:

Do you or any partners have a personal residence?

The SBA 7(A) CRE loan will consider your partners and their assets. In situations where the borrower has several partners, associates with equity in their personal residences are at risk. The loan would require that the residence be listed as collateral.

While this isn’t a huge deal for some people, it could cause uncomfortable decisions on the side of your partners. In this case, the SBA 504 is a safer route to consider.

Can you handle hefty fees?

The fees for the SBA 7(A) rise with the size of the project. For loans over a million, rates can be as high as 3.75 percent.

- Legal Review Fee

- Servicing Fee

- Fee for portion of loan provided by a bank

- Fee payable to CDC (financed by loan)

If fees are a huge concern, the SBA 504 loan may be better suited for your business.

How much down payment can you handle?

Down payment is another factor that will help you choose between the two commercial real estate loans. The SBA 504 loan requires less of a down payment than the SBA 7(A) loan, even when facing the same project size. The difference in the requirements is significant, so this can be a deciding factor for businesses that can’t handle a considerable upfront cost. The SBA 504 loan allows you to borrow much more money, so you may not want the low down payment if you’re looking to pay it off quicker.

If you’re dealing with a larger project, the SBA 504 is an attractive option. It allows for much more money to be borrowed. It also comes with a fixed rate for interest, making the commercial real estate loan terms more favorable for larger projects.

The SBA 506 and SBA 7(A) Loans Are Excellent Options

Funding can be tricky, especially when finding optimal commercial real estate terms. Having a clear understanding of your options for a commercial real estate loan will help you avoid headaches and financial gaps along your investment journey. While these two loans aren’t for everyone, they should show up on your radar as you search for your specific solution.

Finance Lobby is an online CRE lending marketplace that is making it faster and more efficient for commercial real estate brokers and lenders to find their perfect deals. To learn more about Finance Lobby, please see https://financelobby.com/.