A Primer on Negotiating with Commercial Real Estate Lenders

If you are a commercial mortgage broker, you are laser-focused on getting the best deals and terms for your clients. That means you work each day to obtain ideal commercial loan rates from CRE lenders, who also have their own perfect terms. How do both of you meet in the middle without giving away anything vital to your own success? While that will vary from deal to deal and lender to lender, it can be helpful for you to have a strong foundation of knowledge that you can draw upon when negotiating. Below, let’s dig into what you need to know about commercial real estate lenders. Remember: the more you understand “the other side,” the more likely it is that you will be able to successfully negotiate with them.

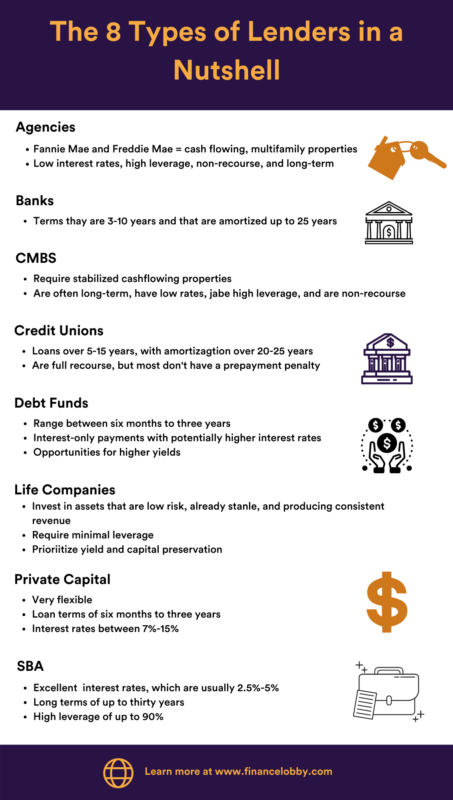

First, take a minute to familiarize yourself with the eight types of lenders for commercial real estate.

When preparing to negotiate with commercial real estate lenders, it helps to keep in mind your financing options: agencies, banks, CMBS, credit unions, debt funds, life companies, private capital, and the Small Business Association.

Which one will you choose? Great question! It will depend on their lending outlook, which can offer vital clues to what they are searching for when offering deals, especially in terms of commercial loan rates.

When targeting commercial real estate lenders, keep in mind two things: the business plan, which may be construction, value-add, or stabilized financing, and product type, which can include hospitality, industrial, multifamily, or office.

Next, we will go more in depth into each type of lender so that you will better understand their motivations, which can help you feel more confident when approaching them.

Agencies, which include Fannie Mae, Freddie Mac, and the United States Department of Housing and Urban Development (HUD)

Congress created Fannie and Freddie in 1938 and 1970, respectively. The basic difference between the two centers on where they source their mortgages. Fannie buys mortgages from commercial banks while Freddie buys them from banks that are much smaller. According to the Federal Housing Finance Agency, each provides liquidity to thousands of banks, savings and loans, and mortgage companies so that they can make loans to help finance housing. You turn to Freddie and Fannie when you are interested in deals for cash-flowing, multifamily properties.

HUD, on the other hand, is an executive department of the United States federal government. It creates national policies and programs to support fair housing in America.

So, why might you be interested in terms from agencies? They can have low interest rates and potential for interest-only periods, and they are high leverage, non-recourse, and long-term.

Additional details to remember about agency loans is that they can include yield maintenance, which is a kind of prepayment penalty that guarantees the lender will completely receive the scheduled payment of interest rates until the loan reaches maturity. Remember that this is typical in the CRE space, and it protects commercial real estate lenders from losing unpaid interest when a loan is paid off early.

Agency mortgages can also include step-down prepayment penalties, which are a percentage of a loan that comes due if the loan is paid off early.

Banks

Banks are primarily motivated by keeping clients for the long term. They want to see customer retention and develop relationships with each person over a period of years. As they do, they will focus on selling products to existing clients, such as credit cards; offering deals to individuals who may be starting a business; and positioning themselves as the commercial real estate lenders to turn to when the client is ready for a large loan.

Normally, banks like stabilized properties, meaning their construction or renovations have been finished, they are high-occupancy, and they have a strong net operating income that can support debt service. For strong clients, they may set aside credit guidelines. With bank loans, you will usually receive terms that are 3-10 years and that are amortized up to 25 years.

CMBS

CMBS lenders, or Commercial Mortgage Backed Security, typically require stabilized, cash-flowing properties. While they will lend for hotels, multifamily, office, or retail properties, you won’t approach them for value-add business plans or construction deals.

Remember that CMBS lenders often are long-term and have low rates. They also have high leverage, are non-recourse, and have potential for interest-only periods.

One of the possible drawbacks with CMBS lenders includes the possibility of defeasance. While the term applies to many situations, what you should remember is that defeasance can make it very expensive for the borrower to refinance their mortgage or sell within the first ten years.

You might consider a CMBS loan if you are a long-term holder looking for leverage and the best commercial loan rate. The CMBS lender will watch for properties that can provide consistent cash flow.

Credit Unions

While credit unions have a lot in common with banks, including the cultivation of long-term relationships with their clients, there are a few differences. While they generally prefer stabilized properties, they may be open to ground-up construction (properties that must be built from scratch, so to speak), and value-add projects (properties that are currently generating income but may need renovations in order to boost their returns).

Credit unions usually provide loans over 5-15 years, with amortization over 20-25 years. While credit unions are full recourse, keep in mind that most don’t have a prepayment penalty, which can make them more attractive to commercial mortgage brokers.

Debt Funds

With real estate debt funds, the investor acts as a lender to the property owner or the deal sponsor. The loan is secured by the property itself, and investors receive a fixed rate of return that’s determined by the interest rate on the loan and how much they have invested.

One of the key advantages is that debt funds offer more flexibility than other commercial real estate lenders.

You might seek out a debt fund if you have transitional property, real estate whose value may become greater in the future. This normally happens if there is a change in zoning or if how a property is used is immediately changed.

The terms you receive with debt funds will generally range between six months to three years. They provide interest-only payments with potentially higher interest rates, though these might be offset by opportunities for higher yields.

Life Companies

Life companies are unique lenders, as they tend to be both conservative and aggressive. Remember when negotiating with them that they get their money from their members’ life insurance policies, so they can be a bit zealous sometimes about guarding their capital.

Perhaps for that reason, life companies prefer to invest in assets that are low risk. These will usually be found in top metropolitan statistical areas and will already be stable and producing consistent revenue. The owner will likely need minimal leverage as well.

Life companies also prioritize yield and capital preservation, so they get aggressive when negotiating interest rates.

Private Capital

Loans secured from private capital are what you expect: financing from individuals or groups who are wealthy enough to provide it. If you can secure it, the good news is that this type of loan will probably come with the most flexibility.

The terms will depend highly on each deal. You will usually get loan terms of six months to three years, and interest rates can be between 7%-15%.

If you pursue this lending avenue, be sure to have your ducks in a row. People with private capital will expect you to lay out a solid business plan and a realistic timeline for paying off the CRE loan.

Small Business Administration

The SBA insures “owner-occupied” or “owner-user” deals that originate with small business owners who seek to own the properties they do business in, including commercial real estate.

The SBA helps small businesses grow by offering excellent interest rates, which are usually 2.5%-5%; long terms of up to thirty years; and high leverage of up to 90%.

How to Choose the Lender That’s Right For You

That is a lot of information to keep in mind, so before you seek out commercial real estate lenders, take a few minutes to jot down answers to these questions:

- How much money will be put down for the CRE loan, and how much will remain to be financed?

- What kind of commercial loan rate are you seeking, and what can you realistically expect to find?

- What kind of property is it? Is the property stabilized, and does it already have good cash flow? Or, will it need renovations?

- What kind of repayment terms are you seeking?

The more specific you get about your ideal terms, the more likely it will be that you will determine the type of lender that is best for your commercial real estate transaction. Remember: financing a CRE property does not have to involve phone call after phone call. Check out Finance Lobby sometime and try a free trial to see how much easier it can be to get perfect-fit deals.

Finance Lobby is an online CRE lending marketplace that is making it faster and more efficient for commercial real estate brokers and lenders to find their perfect deals. To learn more about Finance Lobby, please see https://financelobby.com/.