What Is A Commercial Bridge Loan?

Within the real estate industry, a commonly used option for short-term financing is a commercial bridge loan. These loans “bridge” a gap between other payment or financing options, hence the name. Investors and real estate developers utilize commercial bridge loans when certain types of properties are being purchased or renovated.

These loans have short maturities and typically include terms between six months and three years. Their underwriting is mostly based on the as-is and as-stabilized values as well as the value-add business plan.

Essential Stats of a Commercial Bridge Loan

There are a wide variety of properties that are eligible for a commercial bridge loan. This includes multifamily properties (apartments, condos, etc.), office buildings, retail locations, hospitality (hotels, motels, bed & breakfast establishments), industrial properties, and sometimes even student or senior housing properties.

These loans start at $1 million USD and have an interest rate of 5% or higher over index. The term is typically 12-36 months, although in some cases, extensions may be possible. The amortization is generally interest-only although certain exceptions may occur. For prepayment, there is a minimum interest period.

Advantages of a Commercial Bridge Loan

Compared to other loan options, a commercial bridge loan offers several key advantages. First, they typically requires less time to underwrite. This gives the option of closing escrow more quickly which can save time and money.

Also, the credit requirements for a commercial bridge loan are often significantly less strict than requirements for traditional longer-term mortgages. This is because it is underwritten primarily on the basis of a property’s value and business plan. These loans may be obtained by sponsors with bad credit or no credit.

Third, an interest-only commercial bridge loan lets a developer make interest-only payments while stabilizing the property. They can then defer the rest of the balance until the property is sold or refinanced.

Disadvantages of a Commercial Bridge Loan

Clearly, a commercial bridge loan can be an excellent option in many situations. However, borrowers should keep in mind that these aren’t always the best choice. For example, borrowers who need more time to pay back a loan may need to consider a different financing option, as commercial bridge loans are only for time periods of three years or less.

Also, the interest rates for a commercial bridge loan are typically higher than interest rates for longer-term traditional loans. Higher interest rates can definitely add up over time. Also, there may be higher fees involved with origination, exit, and extensions for these loans as opposed to fees associated with traditional loans.

When is a Commercial Bridge Loan the Best Option?

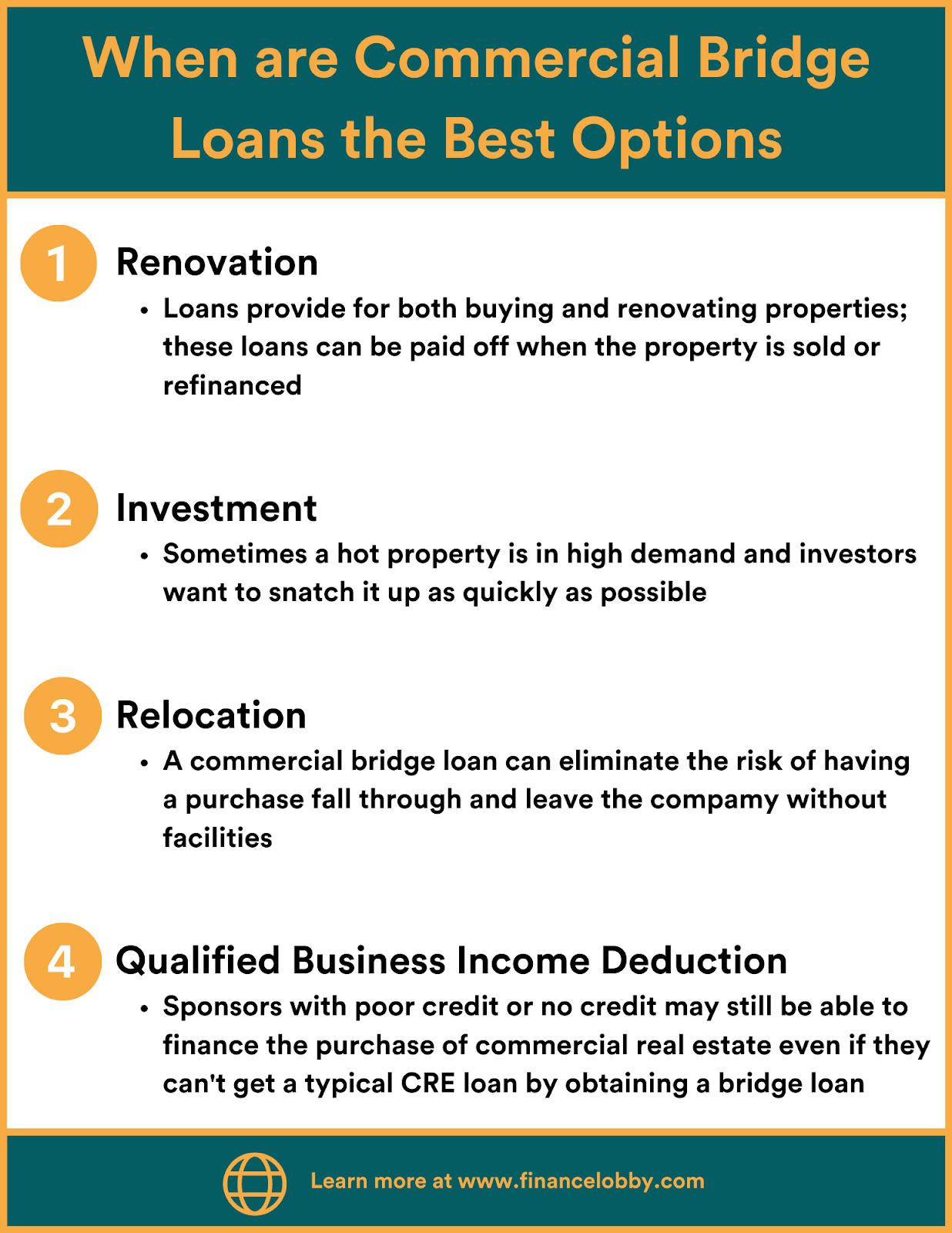

The particular features of a commercial rest estate bridge loan make it a great choice for several types of situations.

-

Renovation: When considering renovating a property, it’s important to have available capital. Loans provide capital for both buying and renovating properties; these loans can then be paid off when the property is sold or refinanced. It’s common for real estate investors to finance properties with unamortized commercial bridge loans, as these can be paid back in a lump-sum payment called a balloon payment.

-

Investment: Sometimes a hot property is in high demand and investors want to snatch it up as quickly as possible. This is when a commercial bridge loan comes in handy, as it takes less time to underwrite than a traditional loan. The property investor can later transfer the financing to a traditional mortgage. A bridge loan lets them close on a high-demand property quickly.

-

Relocation: Businesses have to consider all kinds of factors when relocating, and often, they find themselves wanting to acquire their new property before selling the original property. This gives them time to do any necessary renovations on the new building while staying open for business. A commercial bridge loan can eliminate the risk of having a purchase fall through and leave the company without facilities.

-

Poor Credit: Sponsors with poor credit or no credit may still be able to finance the purchase of commercial real estate even if they can’t get a typical CRE loan by obtaining a commercial bridge loan.

Other Uses for a Commercial Bridge Loan

Short-term commercial real estate loans can be an excellent option for several other scenarios that businesses often face. One example of a good use for a bridge loan is when a business is creating an acquisition deal. The business may acquire a bridge loan to access capital until the acquisition is complete, which works well because there’s already a pending source of capital lined up to pay off the bridge loan.

During the pandemic, and even afterward, many businesses have chosen to stock up on inventory to prevent empty shelves. To do this, a business may require a large amount of capital, so they’ll take out a commercial bridge loan to receive the funds necessary to fill up their warehouse and keep their shelves stocked.

Typical Terms of Commercial Real Estate Bridge Loans

Bridge loans for real estate are more flexible than traditional mortgages because they are not regulated in the same way by state or federal agencies. Bridge loans are offered for six months to three years and can be either amortized (with both the principal and interest paid in monthly installments) or interest-only (paid in a single lump sum upon maturity). Often interest-only monthly payments are available to borrowers; interest rates may be either variable or fixed.

Loan-to-value (LTV) ratios typically vary between 65% and 80%. The LTV ratio is a measure that compares the amount of a mortgage with the appraised value of the property. With commercial bridge loan LTV ratios, higher maximums are usually applied to more desirable properties which are owned by experienced sponsors. As mentioned before, commercial bridge loans start at $1 million USD and can range into the tens of millions of dollars. The duration of the bridge loan and the amount that’s borrowed can affect the maximum LTV allowed.

Typical Features of Commercial Real Estate Bridge Loans

Again, one of the primary features of commercial bridge loans is the short duration. Because the loans are only six months to three years, this makes them ideal for bridging a “gap” between initial financing and other financing solutions. They’re perfect for purchasing a property that will only be held for a few months or years; they’re also a great option for interim financing which will later be replaced by a long-term mortgage.

The primary basis for underwriting is the value of the financed property and the value-add business plan. This simplified underwriting process allows for quick possession and offers options to borrowers with poor credit, as noted.

Another key factor of commercial bridge loans is that they’re often non-recourse loans. These are loans secured by collateral (usually property). If the borrower defaults, the loan issuer can seize the collateral but not demand repayment of the loan, even if the collateral’s value doesn’t equal the value of the loan. Non-recourse loans can offer the option of monthly payments that are only for the interest incurred, and these prevent borrowers from being held personally liable in case the loan isn’t repaid. This is typically only for short-term purchases.

Commercial Mortgage Rate on Bridge Loans

It’s important to remember that short-term bridge loans do tend to carry higher interest rates. This can also vary depending upon the lender. A commercial real estate bridge loan from a bank will often offer interest rates of 6% to 11%, but alternative lenders may charge from 7% up to 30%. This is why it’s best to get the advice of a professional and consider borrowing from a bank.

Bridge loans often do require other additional fees not found with traditional mortgage loans. For example, borrowers may be subject to an origination fee, which is based on the amount being borrowed. Borrowers may also have to pay appraisal fees.

What to Look For in a Commercial Bridge Loan

When considering any kind of loan, it’s always important to evaluate interest rates, terms, the optimum loan amount, any associated fees, and the lender’s reputation. With commercial bridge loans there are two other key factors to consider:

-

Timeframe: Again, bridge loans are short-term loans, and they do not usually take as long to underwrite as traditional mortgages. However, sometimes banks are still slower to underwrite loans (even bridge loans) than alternate lenders. In cases of needing to fill inventory or snap up a high-demand property, borrowers often consider non-bank lenders to move things along more quickly. It’s typically optimum to only consider this if time is very sensitive.

-

Prepayment: While traditional mortgages usually frown upon prepayment, short-term loans such as bridge loans may offer some kind of prepayment incentive. Remember that bridge loans often have higher interest rates and so prepayment can save a borrower thousands of dollars. Bridge loans are designed to be paid off quickly, so a borrower can shop around for a bank or lender offering a commercial bridge loan with an incentive for early repayment.

All factors should be carefully analyzed when considering a commercial bridge loan. For the situations outlined in this article, bridge loans can be a quick and low-cost solution to urgent business needs.

Finance Lobby is an online CRE lending marketplace that is making it faster and more efficient for commercial real estate brokers and lenders to find their perfect deals. To learn more about Finance Lobby, please see https://financelobby.com/.