There’s a strong likelihood that you closely monitor interest rates if you have a loan with a variable rate. A change in interest rates will have an effect on your borrowing costs and uncertainty regarding your monthly payments.

Forecasting debt service levels may be challenging due to changes in variable-rate indexes. An interest rate swap may be a good option if you want to guarantee a fixed cost of debt service without switching to a traditional fixed loan. To protect yourself from the risk of fluctuating interest rates, utilize an interest rate swap.

What Is Swap Rate, and How Is It Calculated?

The swap rate is the agreed-upon fixed rate for a swap set by the participants to the agreement. In order to be rewarded for the uncertainties surrounding variations in the floating rate used in a swap, a receiver will demand the swap rate from a payer. The swap rate can be found in interest rate swaps or currency swaps.

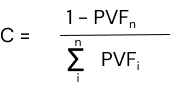

The rate applies to the swap’s fixed payment leg. And to determine the swap rate, you can apply the formula below.

It indicates that the fixed-rate interest swap, denoted by a C, equals one minus the present value factor that is applicable to the swap’s final cash flow date divided by the total of all present value factors applied to all earlier dates.

What Is an Interest Rate Swap?

Interest rate swaps are forward contracts wherein one stream of future interest payments is traded for another based on a predetermined principal sum.

In order to decrease or increase exposure to interest rate variations or to achieve a somewhat lower interest rate than what would have been achievable without the swap, interest rate swaps often include the exchange of a fixed interest rate for a floating rate or vice versa.

A proper interest rate swap contract spells out all of the terms, including the interest rates that each party will be expected to pay the other side and the timing of payments. The swap agreement’s start and maturity dates are also specified in the contract, and both parties are obligated to abide by its provisions up until that point.

Although both parties to an interest rate swap receive what they desire—the first party receives the risk protection of a fixed rate, while the second receives exposure to possible profit from a floating rate—it is important to keep in mind that. In the end, one party will profit financially while the other suffers a loss.

Purpose of an Interest Rate Swap

By making more minor swaps and spreading them in the market through an inter-dealer broker, they frequently spread their interest rate risk.

It aids in mitigating the risk associated with interest rate fluctuation. Long-dated interest rate swaps assist fund managers who desire to work on a long-duration strategy by increasing the portfolio’s total length.

Interest rate swap is used for speculating and developing markets. At first, it was solely for corporations, but as the market expanded, individuals began to see it as a tool to determine the participants’ attitudes toward interest rates. At this point, a large number of fixed-income investors began to participate actively.

If a company has a debt against which they are paying interest, they believe the interest rate will rise in the future. Assume for the moment that this loan is based on three-month SOFR rates.

If the company anticipates that the SOFR rate will skyrocket in the near future, it can hedge its cash flow by choosing fixed interest rates through an interest rate swap. The organization’s cash flow will become more stable as a result.

Examples of an Interest Rate Swap

Consider the following scenario: Company A issued $10 million in 2-year bonds with a variable interest rate equal to the London Interbank Offered Rate (SOFR) plus 1%. Assume SOFR is 2%. The company, concerned that interest rates might increase, locates Company B, which is willing to pay Company A the SOFR annual rate plus 1% for two years on the theoretical principal of $10 million.

Company A pays this business a set rate of 4% over a two-year period on a theoretical value of $10 million. Company A will gain if interest rates rise high. On the other hand, if interest rates decline or remain unchanged, Company B will stand to gain.

Advantages and Disadvantages of an Interest Rate Swap

Interest rate swaps can be fantastic and very helpful. However, employing interest rate swaps has advantages and disadvantages, just like using any other financial product.

Advantages of Interest Rate Swaps

Flexibility

There are many different clauses and structures that can be incorporated into an interest rate swap. They are flexible and can be planned for any length of time using the underlying rate index. They may have diversification, and if liquidity is sought, they may be designed to offer it.

Liquidity

Interest rate swaps with basic conditions and a clear market index are known as “plain vanilla” swaps and are very liquid. The pricing transparency provided by outside sources, such as an independent swap advisor, should reassure credit unions that they are obtaining a fair price when entering into a plain vanilla swap. Interest rate swaps can also be canceled at any moment.

Reliable tool for risk management

Interest rate swaps are helpful in controlling interest rate risk as long as a credit union is aware of its interest rate exposure and the risk it wants to manage.

Disadvantages of Interest Rate Swaps

Legal documentation

An interest rate swap requires the submission of several documents. It may be necessary to hire lawyers or an advisor who specializes in interest rate swaps to help with the document review and negotiation, depending on how comfortable a credit union is with the provisions of the documents.

Counterparty credit risk

The bulk of interest rate swaps is exchanged over the counter, which entails that the credit union and a swap dealer have a contract for the swap. As a result, the credit union takes on credit risk with the swap dealer. This risk can be reduced by mandating the swap dealer to provide collateral.

Who Benefits from an Interest Rate Swap?

Borrowers that anticipate having surplus cash flow may benefit from interest rate swaps. You can pay off that part of the loan more rapidly if rates on the floating side increase. An interest swap can be used to take charge of debt management.

If you anticipate low floating rates to continue, an interest rate swap is also beneficial to take into account. It is feasible, for instance, to maintain a floating rate for the first two years of your company’s seven-year loan and switch to a fixed rate for the next five. With interest rate swaps, innovative design becomes a possibility.

What Are the Risks Associated with an Interest Rate Swap?

Interest rate swaps are a good class of derivatives that can benefit both parties by employing them in various ways. Swap agreements do, however, include some risks.

One substantial risk is counterparty risk. Counterparty risk is usually low because the parties engaged are typically huge corporations or financial institutions. However, it would be challenging for the other party to collect if one of the two parties defaulted and could not fulfill its commitments under the interest rate swap agreement.

It would have a legally binding contract, but the legal process could be drawn out and complicated. Even dealing with the erratic nature of floating interest rates increases the agreement’s underlying risk for both sides.

Conclusion

Interest rate swaps assist businesses in more efficient debt management. The upside of an interest rate swap is that it allows a business to base its debt on fixed or floating rates.

When a business gets paid in either form but prefers the latter, it can swap with a different entity with the opposite objective. Before signing the contract, a business or investor must understand the benefits and drawbacks well.

Finance Lobby is the leading marketplace for commercial real estate financing. We are reinventing the CRE financing industry by making it easier for brokers and lenders to find deals that they can close quickly.

Our CRE marketplace connects supply and demand using a special, preference-based algorithm, matching brokers with the lenders who can seal the deal. Commercial mortgage brokers may cut out mismatches and lost time with Finance Lobby by allowing the marketplace to find the ideal lender for their client’s deal quickly. Sign up now to experience bliss.

Join Free to Get Access