About Us

We took out a mortgage to build this.

Both our sweat equity and actual equity are in this. That’s how deeply we believe that we can help.

Finance Lobby was conceived, designed, built, and brought to market by a passionate group of high-performing mortgage professionals. In their careers, they personally experienced the pains involved in the endless chase of calls, mismatches, denials, fall-throughs, and so on.

At the same time, they also heard from their lender colleagues about time spent on calls about deals they don’t want and the frenetic chase to fill the quarterly bucket. Together, they realized that no one was successfully operating a marketplace to match supply with demand.

Built by passionate CRE experts to empower the CRE community.

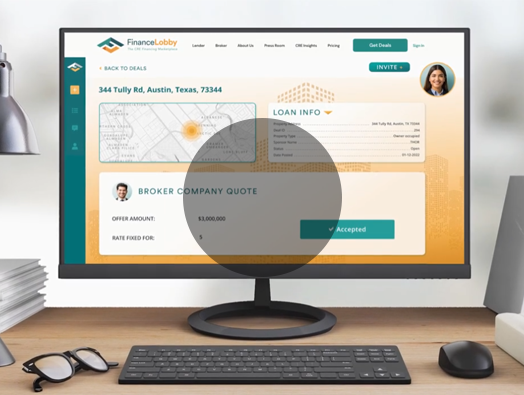

Finance Lobby is Smart, efficient CRE software that matches lenders and borrowers with a level of granular accuracy never previously imaginable, all based on each individual’s lending criteria and the broker’s unique deal requirements.

Our mission is to make sure you have all the options in the market that fit your unique preferences and criteria, so you can close deals more efficiently. Say goodbye to the endless calls and mismatches and hello to the Real Estate Financing Marketplace of your dreams.

Since its launch, Finance Lobby has proven to put ease and joy back into the lending process and to help democratize professionals’ access to opportunities nationwide.

Our values

At Finance Lobby, our mission is to transform and modernize commercial real estate financing to make finding perfect-fit deals easier for all involved.

Our values guide everything we do and every decision we make on the road to making that mission a reality.

User-focused

We view all that we do through the lens of Commercial Real Estate professionals and how we can make your life better.

Committed

We are devoted to changing the way Commercial Real Estate financing is done.

Driven

Good enough is never enough, we’re continuously pushing for better results for you.

Growing

Incremental change leads to big transformations. Whether it’s community size, skills, headcount or any other metric, our growth mindset is the catalyst that builds your business and ours.

Resilient

Changing an industry is tough, there are more walls than doors but we see the obstacles as opportunities to improve. Failure is part of the process and we push through it.

Innovative & Efficient

Whatever we can innovate about CRE financing, we do innovate by using the latest tech and tools. We put actionable information in your hands as quickly as possible.

Collaborative & Community-oriented

We go further together; we collaborate internally to work smarter and we collaborate with you to constantly understand how and where we can improve the process.

As seen in

Testimonials

I like the system. It’s pretty good. I’ve been using it and I intend to use it more. It does work and I do get responses.

The Finance Lobby platform well exceeded my expectations. It was incredibly easy to post a deal, and I did not expect to have three offers within less than 24 hours, at a high quality and with the conditions we were looking for. Honestly, Finance Lobby moved quicker than we were prepared (which is a good problem to have!) and we will be re-posting the deal in 60 days when we will actually be closer to execution.

Your service is excellent! I found everything was laid out nicely and easy to use. I look forward to working together on this deal and many more.

Thanks for the walk-through with the Finance Lobby website. It was really simple to navigate through and create a soft quote. I look forward to seeing more!